Report: Layoffs may loom next year

Updated: 2015-12-17 07:35

By ZHENG YANGPENG(China Daily)

|

||||||||

|

|

More than 18,000 positions were provided during a job fair for graduating students in Beijing on Tuesday. Wang Zhuangfei / China Daily |

China's "invisible unemployment" will become more visible next year, a top Chinese think tank's report warned, as it urged the government to allow more unviable State-owned enterprises to go under.

Invisible unemployment has been the topic of heated discussion recently. In contrast to outright layoffs, invisible unemployment is the practice by which profit-losing State-owned enterprises adopt a strategy of idling employees while giving them part of their wages. They do so due to pressure from employees as well as from authorities to prevent social unrest.

However, the annual economic forecast from the Chinese Academy of Social Sciences predicts that because of the glut of capacity in the heavy industry sector, more SOEs in the sector will "inevitably" face restructuring and bankruptcy next year, and lay-offs will increase.

"With the export sector encountering difficulties as more labor-intensive companies move abroad, jobs created by the sector will drop. However, the service sector will provide more jobs," the report said.

The warning came as Wuhan Iron & Steel Co, a major SOE, reportedly plans to slash 6,000 jobs in three months, while its parent company might cut 11,000 jobs and reduce salaries by 20 percent next year.

Wuhan Iron & Steel spokesman Sun Jin said the company is planning a "human resources optimization". The changes will differ from layoffs, since they won't alter workers' "salaries or organizational relationships" with the company, and the company would still fund their insurance and pension plans, Sun said.

Analysts said this appears to be a typical "invisible unemployment" case.

In the first three quarters, the company had a net loss of 1 billion yuan ($155 million), while the sale of every metric ton of steel incurred a loss of 32 yuan, according to the company's financial report.

Zhou Fangsheng, deputy director of the China Enterprise Reform and Development Society, said his recent survey of Northeast China found that the percentage of SOEs losing money is catching up with the level of the late 1990s, the worst period for SOEs, when 39.7 percent faced losses. Many companies have halted or partially ceased production, which has delayed wage payments.

The CASS report urged the government to give bankruptcy of SOEs a higher priority next year. Failure to do so will "amplify the risks of market-oriented reform", it warned.

- Pandas prefer choosing their own sex partners, researchers find

- Tycoons exchange views on building a cyberspace community of shared future

- China successfully launches its first dark matter satellite

- Report: Layoffs may loom next year

- China launches satellite to shed light on invisible dark matter

- China strongly opposes US arms sale to Taiwan

- Good international coordination a must to combat terrorism

- Chinese embassy: spy report 'sheer fiction'

- US, Cuba agree on restoring commercial flights

- Fed raises interest rates, first rate hike since 2006

- IAEA decides to close nuclear weapons probe of Iran

- Russia, US call for common ground over issues

Canadian college offers flying classes to legless girl

Canadian college offers flying classes to legless girl

Fashion buyer scours the world for trendy items

Fashion buyer scours the world for trendy items

Tycoons exchange views on building a cyberspace community of shared future

Tycoons exchange views on building a cyberspace community of shared future

Snow scenery of Taklimakan Desert in Xinjiang

Snow scenery of Taklimakan Desert in Xinjiang

East China province gets 1st subway line

East China province gets 1st subway line

President Xi delivers keynote speech at World Internet Conference

President Xi delivers keynote speech at World Internet Conference

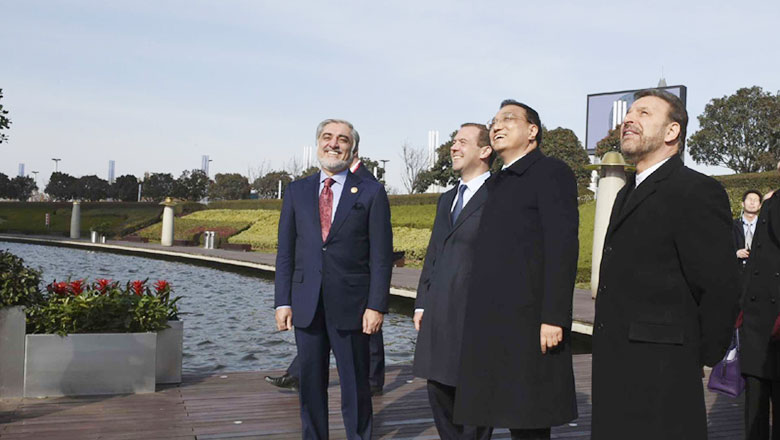

Chinese premier shows Zhengzhou's fast growth to SCO leaders

Chinese premier shows Zhengzhou's fast growth to SCO leaders

Two Chinese Antarctic expedition teams set off for Antarctic inland

Two Chinese Antarctic expedition teams set off for Antarctic inland

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

Islamic State claims responsibility for Paris attacks

Obama, Netanyahu at White House seek to mend US-Israel ties

China, not Canada, is top US trade partner

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

US Weekly

|

|