China: Seeking a clear day

Updated: 2016-09-30 12:12

(China Daily USA)

|

||||||||

Pilot programs

Among the important lessons Chinese officials gleaned from the pilot programs was volatility in the market, price fluctuation and a growing trading volume. "These are good indicators that the market approach might work in China," said Kong.

The pilots also revealed innovation at the local level, Kong said. Allowances in Beijing, Shanghai and Shenzhen reflected those localities, he said.

Kong said one of the problems encountered in the pilots was a lack of sufficient liquidity for trading.

He believes that China's ETS must provide participants with confidence and integrity to succeed: "For society to embrace this, you have to have confidence in the market. And to instill integrity, China has to implement an MRU system - measurement, reporting and verification.

Chinese officials hope the system will become the world's leading carbon market. Spot trades may reach 8 billion yuan ($1.2 billion) per year, resulting eventually in 400 billion yuan in derivative trades annually, Chai Qimin, deputy director of strategy at China's National Center for Climate Change and International Cooperation, told Bloomberg.

One unanswered question is just how far and deep China's ETS will go when it debuts next year. "Some would argue that to implement a system means to actually start trading in 2017," said Nielsen. "Others are suggesting that it will be difficult, but it will work to at least get the framework of the rules for national emission trading."

If the ETS is established and successful, China must then figure out how to price carbon for the other parts of its economy like services and transportation. The nation's new economic goals include annual gross domestic product growth of about 6.5 percent and a greater emphasis on services and valued-added production.

"There is a recognition that it will be difficult for the ETS to cover the entire economy," said Nielsen, who, along with Jorgenson, conducted a seminar in Beijing this summer on how to regulate emissions from the rest of China's massive economy and the potential use of a carbon tax to accomplish that task.

"The Ministry of Finance has long advocated for a carbon tax," said Nielsen. "The National Development and Reform Commission has more of a commitment to building an emission trading system."

Jorgenson said the ETS will cover about 47 percent of the total emissions leaving large segments of the economy like services not covered. He said a pricing system for services presents a different set of problems than one covering the use of coal by a power plant.

Jorgenson said a carbon tax might be a more efficient approach for the services section of an economy. "The idea is that if the carbon tax is administered as part of a tax system, then the collection would be in the hands of the tax authority, which already interacts with all of these firms, even the smallest of them, through the existing tax system," he told the Harvard Gazette.

He said that if China does decide to use a carbon tax for a portion of its economy, the country will have to answer, "How do you integrate a carbon tax that prevails in one part of the economy with a trading system that prevails in another part?"

British Columbia

China may want to look at British Columbia for guidance on a carbon tax. The province is Canada's third-most populous, and it began taxing carbon dioxide and other greenhouse-gas emissions from combustion of fossil fuels in 2008.

According to the US-based Carbon Tax Center, since 2008 per capita emissions of carbon dioxide and other greenhouse gases covered by the British Columbia tax have declined, continuing a downward trend that began in 2004. Averaged across the period with the tax (2008 through 2013; no data are available for 2014), province-wide per capita emissions from fossil-fuel combustion covered by the tax were nearly 13 percent below the average in the pre-tax period under examination (2000-2007).

However, not all are supportive of a carbon tax. The American Energy Alliance (AEA), the advocacy arm of the Institute for Energy Research, said carbon taxes make gasoline and electricity more expensive, with a heavier burden on low-income earners. It will also increase the price of most goods and services since energy is a key cost component, the AEA said.

Jorgenson noted that Australia once had a carbon tax and repealed it.

Contact the writer at paulwelitzkin@chinadailyusa.com

Top 10 Chinese cities with 'internet plus transportation’

Top 10 Chinese cities with 'internet plus transportation’

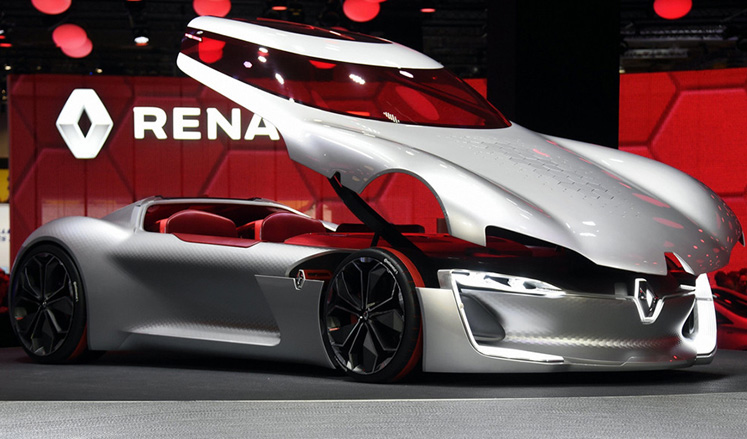

New energy cars shine at Paris Motor Show

New energy cars shine at Paris Motor Show

23 baby giant pandas make debut in Chengdu

23 baby giant pandas make debut in Chengdu

Heritage list salutes Chinese architecture

Heritage list salutes Chinese architecture

Happy hour for prince and princess in Canada

Happy hour for prince and princess in Canada

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Rescue work at the typhoon-hit provinces

Rescue work at the typhoon-hit provinces

Wonderland-like sunrise in East China

Wonderland-like sunrise in East China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|