Small firms' last resort for financing

Updated: 2013-01-21 07:56

By Yu Ran in Shanghai (China Daily)

|

||||||||

|

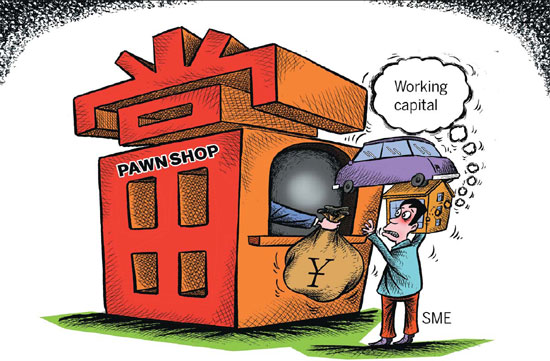

Many small- and medium-sized enterprises' owners went to pawnshops and mortgaged their cars for short-term loans during the year-ending period. SMEs are increasingly facing a working capital crunch, as banks are reluctant to lend to them due to their poor business record. Liu Daowei / For China Daily |

Many private business owners turn to pawnshops to find alternate funding options

After knocking on several doors, Wu Xiang finally raised the money required for urgent business expenses from a pawnshop in Tianjin by pledging his more than 2 million yuan ($321,000) Porsche Panamera as collateral for a cash loan.

Though the monthly interest of 4 percent on the 1.5 million yuan loan is steep, Wu, the 34-year old owner of a small trading company in Tianjin, says he has no regrets in pledging his prized car as "profit margins are shrinking and there are virtually no other financing avenues."

Wu, is not alone in his predicament as several small- and medium-sized businesses in China are struggling to find alternate financing options to stay afloat especially in the November-December period.

Like Wu, many of the small and medium business owners are now increasingly turning to pawnshops, so much so that they have become an integral part of China's modern financial landscape.

"I urgently needed 1.5 million yuan to make the balance payments to my business partners, pay a final loan amount to the bank and for the salaries of my employees before the end of the month," Wu said.

Having said that, Wu adds that he would redeem the prized car as soon as he gets alternate financing from a bank. He says that this is not the first time that he has had to trade in his belongings for short-term funds as he had earlier pledged his apartment for a two-month loan of four million yuan in 2011.

Unlike the loan procedures in financial institutions, which normally take up to a month for approval, pawnshops often offer instant money. The process usually consists of pledging the assets along with the related documents at a pawnshop.

"I needed to solve my financial problems within two weeks, and pawning the car was the quickest and easiest way to raise funds," said Wu.

Traditionally, people pawned clothes, antiques and valuables like gold, silver or jade at pawnshops. However, in recent times Chinese pawnshops have become much more diverse and seen assets like real estate, private cars and equity shares being pledged for quick money.

"Efficiency, convenience, flexibility and customized service often make pawnshops the most preferred financial channel for individuals and enterprises," said Yang Yong, the manager of the automobile business department at the Huaxia Pawnshop in Beijing.

Huaxia has grown to become one of China's biggest pawnshops since its launch in 1993 and currently has over 20 branches in Beijing.

"People are no longer going to pawnshops for survival, but consider it a viable option to deal with emergencies," Yang said.

He admits that demand for private automobile pawn services normally goes up between November and February as it is the period when SME owners often need huge amounts of money quickly.

"The number of customers using car pawn services have increased 20 percent in 2012 compared with the numbers in 2011," Yang said.

"About 60 percent of my clients are regular customers who have private cars. Many of these high-end vehicles are often left in our pawnshops during various periods of the year for quick money purposes," he said.

At Huaxia Pawnshop, the monthly interest for a private car is 3.5 percent, the weekly interest is 1.8 percent, and the fifteen-day interest is 2.1 percent.

"I've noticed that more high-end cars are coming into the pawnshop and being traded for higher loan amounts this year."

The growth in use of pawnshops is not confined to Tianjin or Beijing but has spread across most Chinese cities. But it is in Wenzhou, the hub for small- and medium-sized businesses that this trend is most evident.

In the large car parking garage of an automobile trading center in Wenzhou, at least one-third of the used cars are vehicles that have been pawned at local pawnshops.

"Nearly 60 percent of the parking space at the center has been leased out to nearby pawnshops as they have regular clients with expensive vehicles," says Ji Xiao, sales manager of Wenzhou Outong automobile Co, a car company that sells new and second-hand cars at the center.

Ji says that expensive cars are normally redeemed within a week. Cars that have not been redeemed for more than a month are often sold at low prices in the center to local buyers.

The burgeoning demand for car pawn services has also triggered more problems for pawnshop owners due to the higher default risks.

When the redemption period passes, the goods often end up as "dead pawns", meaning the pawnshop has the right to sell them at a low price.

"Most of the owners redeem their cars on time before the redemption period ends, but if they fail to repay the interest and the amount of borrowed money, we have to sell the cars for cash," said Ye Zhitong, the manager of a Beijing-based pawnshop.

Ye added that it is not easy to sell the cars to second-hand buyers due to the stiff restrictions on purchase of personal cars in Beijing.

The run-up to the forthcoming Chinese New Year has been overwhelming for most of the pawnshops in China as the tight loan policies for SMEs have severely dented prospects for several businesses.

Non-performing loans at the 16 listed banks in China have exceeded 387 billion yuan, 18 billion yuan more than the beginning of the year, payment service provider China UnionPay Co said in a recent report.

With most of the banks looking to trim their lending risks by limiting the loans to small- and medium-sized businesses, it has been the small-loan companies that have actually benefited, the report said.

According to data published by the China Microfinance Institution Association, the more than 6,000 small-loan companies in China had by the end of 2012 disbursed loans worth more than 600 billion yuan, 52 percent higher than the previous year.

Last year, 26 small-loan companies were authorized, while 31 new companies opened their doors for business in Wenzhou, Zhejiang province.

"The targeted customers of these companies are mostly owners of local SMEs, who have failed to meet the requirements set by financial lenders," said Zhuang Zhonghua, the general manager of Wenzhou Yizhao Small-Sum Loan Corp Ltd, which was launched in March 2010 with a registered capital of 200 million yuan.

Of the 400,000 privately owned enterprises in Wenzhou, nearly 30 percent are not qualified to seek financial assistance from State-owned banks and hence need to borrow money from loan companies.

"Properties and personal belongings such as cars are also accepted as collateral for short-term loans especially during the year-ending period, when cash becomes really tight," said Zhuang.

The registered capital of Wenzhou Yizhao Small-Sum Loan Corp Ltd, comprising of 12 shareholders was increased to 400 million yuan in 2011.

The total amount of money available for loan lending in the company is 500 million yuan including 1 million yuan loan from a financial institution. The maximum amount of loans that an individual can avail from the firm is 1 million yuan with a monthly interest rate of 1.7 percent, about three times higher than the interest rate charged by State-owned banks.

"We want to help small- and micro-enterprises with more accessible loans. But we also have to control risks and so we have to increase the interest rate," said Zhuang.

yuran@chinadaily.com.cn

(China Daily 01/21/2013 page15)

In Photos: 7.0-magnitude quake hits Sichuan

In Photos: 7.0-magnitude quake hits Sichuan

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Live report: 7.0-magnitude quake hits Sichuan, heavy casualties feared

Boston suspect cornered on boat

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|