Chinese companies endeavor to build up global brands

Updated: 2013-09-17 07:24

By Kathy Tian (China Daily)

|

||||||||

If someone asked you "What country manufactures most of the products you use?" you would probably respond, without hesitation, "China".

What if the question instead was "Name a global Chinese brand?"

Go ahead, think about it. Don't feel bad if you can't come up with more than one. People would be impressed if you could identify even two.

We are all aware that these days, anything from apparel to advanced technology, medical equipment to household supplies, can be found with "made in China" on the packaging.

Despite its increasing prominence on the global stage and indisputable economic dominance, China still lags behind in building successful global brand names.

Brands based in China failed to appear on Interbrand's list of the 100 Best Global Brands of 2012. Even tiny Finland, with a population of just more than 5 million, managed to grace the list with Nokia Corp at number 19.

More astonishing, a survey conducted by HD Trading Services Inc, a marketing and brand development company, revealed that out of 1,500 Americans surveyed, 94 percent couldn't name a single Chinese brand.

"There are many hurdles to the development of global brands by Chinese companies," said Jan-Benedict Steenkamp, a professor of marketing at the University of North Carolina's Kenan-Flager Business School.

"National image is a major issue for Chinese corporations, since in the minds of Westerners, Chinese products are associated with being unreliable," Steenkamp said.

"Another hurdle is production focus. Companies from China are thinking about the market in terms of scale and mass production. To create a strong brand, the value is more important."

Being a vast country with a population of more than 1.35 billion is both a blessing and a curse for China. "This massive domestic market was enough to feed industries in the past, so companies did not feel compelled to expand into the international market," said Yubo Chen, a professor at Tsinghua University.

This situation may soon change, however, as the cost of labor in China continues to rise. China's working age population (aged 15 to 59) fell by nearly 3.5 million in 2012, significantly diminishing the supply of cheap labor.

A study by the consulting firm AlixPartners estimates that the cost of outsourcing manufacturing to China will be equal to the cost of manufacturing in the US by 2015.

"China will not be able to appeal to the price-sensitive in the future since wages for laborers are increasing and manufacturing is becoming more expensive," Steenkemp said. "The lowest-price tactic to becoming a recognized brand is a dead-end street."

How can China break through these barriers and create a successful brand in the global market?

Perhaps the key step is to place greater emphasis on the quality of merchandise rather than the price.

"China thinks about the mass markets; it does not produce for a target segment, so there is nothing special about the product," said David Reibstein, chairman of the American Marketing Association.

If Chinese companies shed the national image of having poor-quality goods, they may be able to gain a loyal consumer base, which is essential to the success of branding.

Another approach that China can take in brand-building is the slow-and-steady strategy that Steenkamp has dubbed the "Asian Tortoise Method".

China's neighbors, Japan and South Korea, used this model to establish themselves in the global market.

It takes time and patience to create a reputable brand. It took the Japanese 20 years and the Koreans a little more than 10 years to do it.

When South Korea's Hyundai began selling its cars overseas, it had a negligible market share.

"By providing a top-quality warranty," Steenkamp said, "Hyundai was able to attract consumers." Today, Hyundai vehicles are perceived to be of high value and frequently score higher than BMW in some areas of quality.

China can also deploy this tactic of offering good warranties and letting product quality speak for itself over time.

Haier Group is an example of a Chinese company that has moved up in rankings by slowly migrating to higher quality and better brand premiums. It has become the world's largest white goods manufacturer.

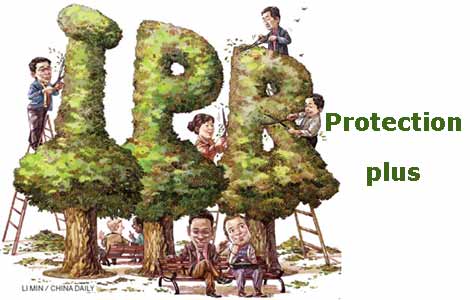

Companies can also learn from successful domestic brands, such as Beijing-based Lenovo, and recycle the strategies used by them.

Lenovo Group Ltd is one of China's most prominent international brands and has overtaken Hewlett-Packard Co as the world's leading personal computer producer by volume. The prosperity of the company stems from its ability to be adaptive to the global market and the way in which it is managed.

Lenovo is managed much like a privately owned Western company, and beyond the seed money, there is little government interference.

Most senior executives at the company also haven't been Chinese citizens. Many are recruited in Europe and the US. This allows the company to have access to a more global view and create innovative products that are attractive not only to domestic consumers but overseas ones as well.

Other enterprises can follow in the footsteps of Lenovo and seek employees with knowledge of the global market.

Businesses can also overcome the issue of poor national image by buying global brands from Western multinationals. TCL Corp and Lenovo are examples of companies that have bought established Western brands and used their trusted names to gain a footing in the competitive global market.

Vertical integration through acquisition helped Lenovo rise and grow. In 2005, Lenovo announced its acquisition of IBM Corp's PC division, giving Lenovo rights to the IBM name. Mergers and acquisitions with other existing and reputable companies can be a good way for China to introduce products.

The bottom line is that China has to build a brand with better value. The cost of labor is rising. It is the next logical step.

The author is a freelance journalist based in Beijing.

(China Daily USA 09/17/2013 page14)

'Amazing Shanghai' on display in Big Apple

'Amazing Shanghai' on display in Big Apple

Thirteen dead in US Navy Yard shooting

Thirteen dead in US Navy Yard shooting

Exporters to face more trade friction

Exporters to face more trade friction

Toddler-death defendant says he meant no harm

Toddler-death defendant says he meant no harm

Watchdog bites with no favor

Watchdog bites with no favor

Miss New York crowned 2014 Miss America

Miss New York crowned 2014 Miss America

Summers withdraws from Fed chair contest

Summers withdraws from Fed chair contest

Scientists make land arable again

Scientists make land arable again

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trending news across China, Sept 17

BRICS pledge cooperation on climate change

CBRC set to regulate 'chaotic' WMPs

Exporters to face more trade friction

Thirteen dead in US Navy Yard shooting

China, US team up on Central Asia

UN confirms nerve gas used in Syria

Minimum growth rate set at 7 percent

US Weekly

|

|