Alibaba denies IPO venue rumors

Updated: 2013-09-27 12:46

By Michael Barris in New York, Gao Changxin in Hong Kong and Meng Jing in Beijing (China Daily)

|

||||||||

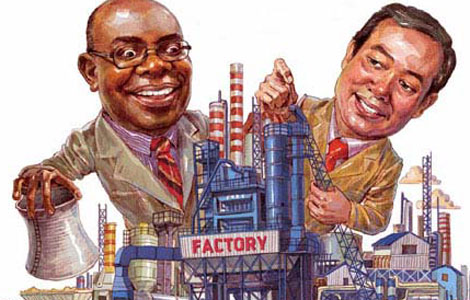

E-commerce giant Alibaba Group Holding Ltd dismissed as untrue published reports that it has decided to hold an initial public offering that could raise up to $75 billion in New York instead of Hong Kong.

In an interview with China Daily, an Alibaba representative in Beijing repeated the company's statement earlier this month that it has made no final decision on the timing, location or terms for the IPO, projected to be one of the world's biggest this year.

"Reports claiming that Alibaba has chosen the US over Hong Kong are not true," said the representative, who asked not to be identified.

Alibaba Chief Executive Jonathan Lu also attempted to diminish the reports. Through his account on Laiwang, a mobile chatting app recently launched by the company, Lu replied "not yet" to a China Daily reporter who asked whether Alibaba had chosen to list in the US rather than Hong Kong and whether the company had received a final response from the Hong Kong stock exchange on its request for a change in board-nomination procedures. He did not say whether his response was to one question or both.

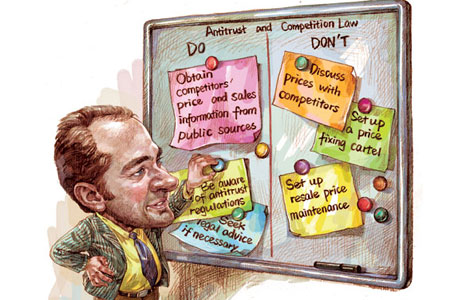

Alibaba has been in talks with the Hong Kong exchange's listing panel to establish a system whereby founder Jack Ma and other top executives could nominate most of the company's board and submit the proposed directors' slate to shareholders for a vote. The managers' goal is to retain voting power over Alibaba's strategic direction and culture.

Hong Kong doesn't allow the dual-class structure favored by Facebook Inc, Google Inc and other US-listed technology companies. The Hong Kong exchange's charter says shareholders should have equal rights.

Published reports said that if Hong Kong regulators failed to approve Alibaba's board-nomination request, the company would switch the listing venue to New York, where such a corporate structure is allowed.

That change of venue would come as Hong Kong needs a heavyweight such as Alibaba to revitalize its faltering IPO market. The territory was the top global destination for IPOs from 2009 to 2011, but a slowing economy has caused many companies to postpone their IPOs.

There's no guarantee holding its IPO in New York would translate into a big payoff for Alibaba, despite its prominence in China. Recent accounting scandals involving US-listed Chinese companies have created a chilly climate for IPOs from the country, resulting in few IPOs from China seeking listings on US exchanges and hurting the share prices of Chinese companies which already trade on the US stock market.

But Alibaba would be the most widely anticipated IPO since Facebook's $16 billion offering in May 2012 - the third largest in history.

Hong Kong, in comparison, has had fewer legal battles and a long record of hosting Chinese mainland companies incorporated overseas and listed in Hong Kong. Alibaba is incorporated in the Cayman Islands.

Hong Kong media outlets reported that the listing committee of Hong Kong Exchanges & Clearing Ltd, at its weekly meeting Thursday, discussed the IPO and decided not to make rule changes to accommodate Alibaba's corporate structure. A spokeswoman for the Hong Kong exchange declined to disclose the substance of the committee's discussions, saying they are not public information.

Hong Kong exchange CEO Charles Li suggested that the exchange might not compromise its rules for Alibaba. Li wrote in a blog post on Wednesday that "as enshrined in our charter, in the event of a conflict, public interest is put ahead of shareholder interest at HKEx".

Contact the writers at michaelbarris@chinadailyusa.com, mengjing@chinadaily.com.cn, gaochangxin@chinadaily.com.cn

(China Daily USA 09/27/2013 page1)

- Is Alibaba using a 'negotiating ploy' with HK?

- Alibaba acquires cloud storage company Kanbox

- Alibaba seeks special terms

- Alibaba launches mobile chat app

- Alibaba forms partnership with Minsheng Bank

- Alibaba sales 'to exceed entire US e-commerce'

- Alibaba may be using 'negotiating ploy' with HK exchange: Professor

- Alibaba reinforces shift to devices

Serena Williams back to Beijing for new crown

Serena Williams back to Beijing for new crown

'Battle of the sexes' to start China Open

'Battle of the sexes' to start China Open

US astronaut praises China's space program

US astronaut praises China's space program

Christie's holds inaugural auction

Christie's holds inaugural auction

Aviation gains from exchanges

Aviation gains from exchanges

Early fish ancestor found

Early fish ancestor found

Singers' son sentenced to 10 years for rape

Singers' son sentenced to 10 years for rape

Djokovic announces engagement to girlfriend

Djokovic announces engagement to girlfriend

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trending news across China

Overseas entrepreneurs connect with reform

Russia to guard Syria chemical weapon destruction

Interpol issues arrest notice for 'white widow'

US astronaut praises China's space program

China to join talks on trade in services

Philippines-US drill raises concern

Alibaba denies IPO venue rumors

US Weekly

|

|