Property buyers scouring the world in diversification drive

Updated: 2014-01-28 07:54

By Hu Yuanyuan (China Daily USA)

|

||||||||

Preview for 2014: Emigration economy

Editor's Note: About 50 million Chinese people are living overseas at present, according to the Beijing-based Center for China and Globalization.

Investment and education are the main drivers of Chinese migration. Four countries - the United States, Canada, Australia and New Zealand - are the most popular destinations, the center said. The expanding number of Chinese emigrants is creating business opportunities for a range of industries.

|

A New York property project display at an international housing exhibition in Beijing attracts investors. Continually rising prices and tightening measures are pushing more Chinese investors to seek opportunities overseas. Wu Changqing / For China Daily |

Chinese investors are increasingly looking at the big picture

It took Sara Wang two days to decide to buy a two-bedroom apartment in London in October.

The 35-year-old executive in a joint venture enterprise acquired the home only as an investment.

She already has two apartments in Beijing, which means she isn't allow to buy any more properties in the capital. And soaring property prices in China also make her worry about growing investment risk.

She paid the equivalent of 4 million yuan ($645,160) for the apartment in suburban London. The down payment was 30 percent. She expects to rent it for about 12,000 yuan per month.

The purchase, Wang said, was a good deal based on the price-to-rent ratio and relatively low monthly payments.

If she wanted to buy another apartment in China, she wouldn't be able to get a mortgage, as she took out mortgages for her first two apartments.

In any case, the rent for a 4 million yuan apartment in Beijing would only be about 7,000 yuan now.

"Moreover, in London, I get a 999-year lease. But in China, I paid for 70-year use rights," Wang added.

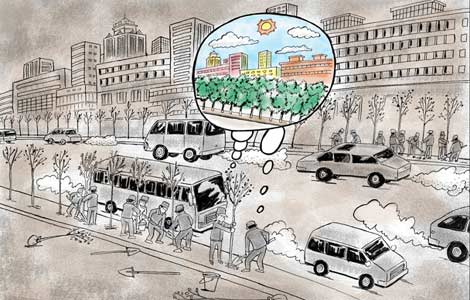

Continually rising prices and tightening measures are combining to push more Chinese investors to seek overseas opportunities.

Chinese buyers are the most influential in the world's prime markets for new housing, according to Knight Frank LLP's latest Global Development Insight report on the spending habits of affluent individuals around the world.

Chinese buyers are the top purchasers of new residential property in Sydney and Hong Kong, and they're also active in Kuala Lumpur and Bangkok, according to the report.

They are growing in strength in key Western markets, particularly New York. Their global presence is driven by the strong yuan and slowing domestic economy, which are encouraging Chinese investors to look further afield to diversify their risk, the report said.

"In China, we are seeing increasing interest in buying new homes overseas. And the main type of buyers has changed from migration-oriented to investment-oriented, said Maureen Yeo, associate director of international project marketing at Knight Frank Beijing.

"More buyers are targeting the overseas property market to diversify their investment portfolios," she said.

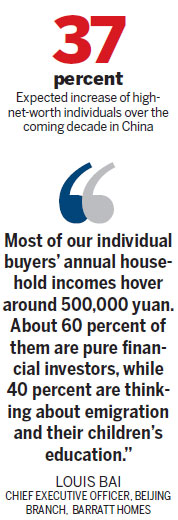

According to Louis Bai, chief executive officer of the Beijing branch of Barratt Homes Plc (a United Kingdom-based developer), members of China's emerging middle class, not millionaires, have been the major buyers of the company's projects in London this year.

"Most of our individual buyers' annual household incomes hover around 500,000 yuan. About 60 percent of them are pure financial investors, while 40 percent are thinking about emigration and their children's education," Bai said.

"Diversifying their investment portfolio is a key motivation in buying overseas property," he added.

China's growing importance in the international real estate market also reflects the rise of Asia as a wealth creation hub.

Asia is second only to North America in terms of its billionaire population, and the number of high-net-worth individuals in China is forecast to rise by 137 percent over the coming decade, according to Knight Frank.

Property curbs in Asia have driven many investors from the region to look further afield.

Singaporean and Russian investors are the next most active buyers of new residential property around the world, followed by UK and US buyers, according to the report.

About 39 percent of people surveyed cited political and economic risk in a buyer's home market as a key driver for international demand.

Another 47 percent of respondents stated that 'the safe haven effect' was the chief factor. Education and lifestyle are increasingly important when investing overseas, according to the report.

huyuanyuan@chinadaily.com.cn

(China Daily USA 01/28/2014 page16)

Putin pays tribute to Siege of Leningrad victims

Putin pays tribute to Siege of Leningrad victims

Chinese ace Li Na before she was famous

Chinese ace Li Na before she was famous

Xi visits soldiers on frozen northern border

Xi visits soldiers on frozen northern border

Premier calls for action to relieve poverty

Premier calls for action to relieve poverty

Tough Guy event in England

Tough Guy event in England

Syria talks bring offer of exit from siege of Homs

Syria talks bring offer of exit from siege of Homs

Anti-World Cup protests wane in Sao Paulo

Anti-World Cup protests wane in Sao Paulo

India celebrates 65th Republic Day

India celebrates 65th Republic Day

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

South China Sea archives open in Hainan

Some good US advice for Japan on comfort women

US, UK in app-tapping scandal

Border control for H7N9 tightens

Int'l hacker got caught in China

Party to reform discipline system

Talent returns to China, but progress slow

300 ill on Royal Caribbean ship

US Weekly

|

|