Luxembourg woos China for yuan business

Updated: 2014-03-17 07:22

By Cecily Liu (China Daily)

|

||||||||

Grand Duchy sets its sights on being European hub for renminbi trade

Although the renminbi has attracted a host of suitors from across the world, it is banking on a small European nation to boost its global standing as an investment currency.

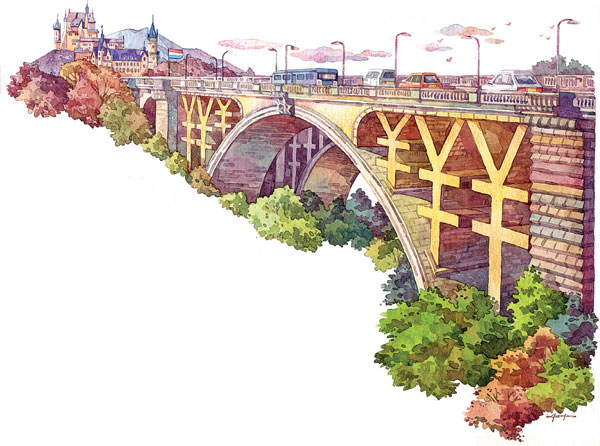

Move over London, Frankfurt and Paris. The Grand Duchy of Luxembourg, a tiny land-locked Western European nation, seems to be far ahead of others when it comes to attracting renminbi business in Europe, sources say.

"Luxembourg has played a key role in increasing the liquidity of the Chinese currency globally," says Nicolas Mackel, chief executive of Luxembourg for Finance, an agency that works for the development of the financial sector in Luxembourg.

The Grand Duchy, which hosts the European headquarters of three major Chinese lenders, has issued 44 renminbi bonds to date and is home to a growing number of renminbi-focused funds. Unlike London, Frankfurt and Paris, which boast of natural advantages such as bigger trade flows with China and familiarity with investors, Luxembourg is banking on its position as an important investment and finance hub in Europe.

According to sources, cities such as London have not been that popular with Chinese lenders because of the unfavorable environment and strict regulations. London has issued only four renminbi bonds to date, although it had a head start over other cities in Europe.

On the other hand, the big concentration of Chinese banks in Luxembourg has ensured that it has become an important part of China's outbound trade, finance, investment and mergers and acquisition deals in Europe. This has also helped boost the scale and liquidity of the offshore renminbi pool in Luxembourg, sources say.

"Luxembourg's trade with China is tiny. But any currency on its way to being a global reserve currency has to be a trade currency and also an investment currency, which is where we come in," Mackel says.

According to official figures as of December 2013, Luxembourg has the largest pool of renminbi in the eurozone with 64 billion yuan ($10.42 billion) in deposits, 53.8 billion yuan in loans, 24.7 billion yuan in renminbi bond listings and 256.4 billion yuan in renminbi-denominated assets held in investment funds.

Luxembourg finance minister Pierre Gramegna recently indicated that he would press for the setting up of an official renminbi-clearing bank and for an RQFII quota during his upcoming trip to China.

RQFII, which stands for Renminbi Qualified Foreign Institutional Investors, is a program launched by the Chinese government in 2011 that allows qualified overseas financial institutional investors from overseas to invest in China's onshore financial markets directly using the renminbi.

An official clearing bank facilitates the efficient clearing of offshore renminbi transactions, achieved through the appointed bank's direct cooperation with the People's Bank of China, the Chinese central bank.

One of the key drivers behind the growth of renminbi transactions in Luxembourg is the city's growing number of funds that invest in renminbi opportunities. These funds, collectively called UCITS, which stands for Undertakings for Collective Investment in Transferable Securities Directives, are recognized by institutional investors globally, especially in Asia and Latin America.

For this reason, an increasing number of fund managers create UCITS in Luxembourg for global distribution and a growing number of these UCITS focus on investing in offshore renminbi products including "dim sum" bonds, sources say. Dim sum bonds are bonds issued outside China and issued in yuan.

"There are many Luxembourg-based UCITS funds that invest in the offshore renminbi market," says Stefano Chao, an investment manager at AZ Investment Management, which is a subsidiary of Italy's largest independent asset manager Azimut Holding.

"When we talk to institutional investors in Latin America and Asia, they feel comfortable about investing in UCITS. Luxembourg in this sense is a good jumping point for the internationalization of the renminbi, because Luxembourg funds that invest in renminbi can be bought by international investors globally," Chao says.

Liberalization journey

China's push to internationalize its currency started in 2008, when the global financial crisis demonstrated the danger of over-reliance on the US dollar.

During the 2008 G20 summit in Washington, former Chinese president Hu Jintao called for "a new international financial order that is fair, just, inclusive and orderly".

Beijing soon began to encourage the use of its currency in international trade and swap arrangements among central banks and bank deposits and bond issuances in Hong Kong.

Trade in offshore renminbi has since boomed. Increasing Chinese exports also led to a surge in demand for renminbi outside China as Chinese exporters increasingly expect to be paid in their own currency to eliminate exchange risks.

"For a country that's predicted to become the largest economy in the world, it's only logical that the currency also goes global. Renminbi internationalization is a big theme, but it is really about China opening up," says Rongrong Huo, head of renminbi business development at HSBC Europe.

"Many Western countries have increasingly realized they want to engage with China. Offshore renminbi activities are a good way to start that engagement," she says.

Following Hong Kong's success in growing offshore renminbi products and services, other international centers including London, Paris, Frankfurt, Luxembourg and New York all entered the race to become a Western center for offshore renminbi.

One area of significant development seen over the last few years is the trend by European companies of switching to renminbi invoicing when trading with their Chinese partners, to avoid exchange risks and to receive better margins.

London, for example launched an initiative in April 2012 to make renminbi trade processing easier for European businesses and offered companies and investors the opportunity to trade, invest and bank in renminbi in London.

Led by the City of London Corp and involving efforts from 13 Chinese and Western banks, the initiative achieved considerable progress. Trade finance transactions using the Chinese currency totaled 27.94 billion yuan in the first half of 2013, up from 13.8 billion yuan a year earlier.

"The confidence among clients in utilizing and trading in renminbi has increased probably 200 percent since we started this initiative. So we've seen clients actually wanting to trade in renminbi and invoice in renminbi," says Sonia Rossetti, managing director of Europe and head of product management at Standard Chartered Plc.

Other European centers such as Paris and Frankfurt have also been growing their renminbi trade settlement and trade finance capabilities.

Currently about 10 percent of Sino-French trade and Sino-German trade is settled in France and Germany, according to statistics from the French central bank Banque de France and Frankfurt Main Finance, a financial association that represents major German banks.

Bernard Poignant, China adviser at Paris Europlace, an organization responsible for coordinating and developing the Paris financial marketplace, says the growing use of renminbi for trade transactions demonstrates "concrete efforts to promote the use of renminbi with French customers dealing with China" by French banks.

"Our goal is to increase the percentage of commercial trade in renminbi. Many small and medium-sized businesses will not know about this option and its benefits if we don't explain it to them," Poignant says.

Poignant's views are echoed by Lutz Raettig, chairman of the supervisory board of Morgan Stanley in Frankfurt, who adds that German banks are working hard to ensure sufficient renminbi liquidity to facilitate the growing renminbi trade flow.

Globally, renminbi usage in international trade finance grew to 8.66 percent in October 2013, from just 1.89 percent in January 2012, according to Society for Worldwide Interbank Financial Telecommunication figures.

This milestone made the renminbi the second-most-used currency for trade finance internationally, behind the US dollar, which has a share of 81.08 percent. About 18 percent of China's global trade is now denominated in renminbi, compared with less than 1 percent nearly four years ago.

Next step

But becoming an international trade currency is only the first step in the renminbi's progress to become a global reserve currency. The next key step is to turn it into an investment currency, because global investment flows are far larger than trade flows.

To achieve this, many offshore renminbi products have been developed in recent years. One notable example is the offshore renminbi bond, which helps companies to raise funds in offshore renminbi.

Currently Luxembourg Stock Exchange lists the second-largest number of offshore renminbi bonds globally after Hong Kong.

That doesn't appear surprising considering that the Luxembourg bourse always had a global focus, especially after listing the first eurobond in 1963.

"We were interested in international business early on and have become good at listing bonds. We have developed additional after-sale services for issuers, so it's not just a one-off service," says Robert Scharfe, CEO of the Luxembourg Stock Exchange.

Scharfe says listing a large number of renminbi bonds on the Luxembourg Stock Exchange brings numerous benefits to the local economy, despite the fact many issuers and investors of the bonds are not based in Luxembourg.

In addition to the listing fees received by the stock exchange, Luxembourg's local law firms and banks also gain from such moves because they can provide services to the bond issuers. Their proximity to and understanding of the Luxembourg investment environment is of great help to the bond issuers, Scharfe says.

Because most of the bond listings are structured using a special-purpose vehicle for legal and tax reasons, many of these SPVs are domiciled in Luxembourg. Most of the bond transactions are cleared by Clearstream, a Luxembourg-based clearing house.

Elsewhere in the world, Asian financial centers such as Singapore, Taiwan and Macao are following Hong Kong's footsteps to grow offshore renminbi activities, fully utilizing their advantage of geographical proximity to the onshore Chinese mainland market.

Industrial and Commercial Bank of China in Singapore and Bank of China in Taiwan and Macao have been appointed as official clearing banks over the past few years, giving a boost to the liquidity of offshore renminbi flows to the three centers.

Last March Singapore and China also doubled the value of its swap line to $48 billion, three years after it was initially established.

Under a swap agreement, central banks agree to exchange each other's currency and can then lend the money out to domestic banks in cases of emergency. It is considered an effective tool to boost market confidence in the renminbi.

Another key driver behind Luxembourg's progress in developing offshore renminbi activities is the growth of Chinese banks in the city.

cecily.liu@chinadaily.com.cn

(China Daily 03/17/2014 page13)

Crimeans start celebrating pending referendum outcome

Crimeans start celebrating pending referendum outcome

European universities growing in popularity among students

European universities growing in popularity among students

Muslims in Malaysia pray for missing plane

Muslims in Malaysia pray for missing plane

Ukraine's Crimea kicks off referendum

Ukraine's Crimea kicks off referendum

Travel-tourism forum advises US to 'loosen' visa requirements

Travel-tourism forum advises US to 'loosen' visa requirements

Nose gear on plane collapses at Philly airport

Nose gear on plane collapses at Philly airport

US Black Sea naval drills start near Crimea

US Black Sea naval drills start near Crimea

Cooperation at the heart of win-win, Li tells world

Cooperation at the heart of win-win, Li tells world

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US not to recognize Crimean referendum

Missing jet pilots' motive probed

Alibaba opts for IPO in US

Stronger cop presence urged after knife attacks

Crimea kicks off referendum

Kindergarten closed for drug use

Xi stresses building of strong army

Dispute triggered knife attack in C China

US Weekly

|

|