The Waldorf's hefty price tag

Updated: 2014-11-14 13:35

By Liu Lian(China Daily USA)

|

||||||||

It's the most ever paid for a New York City hotel: $1.95 billion for the Waldorf Astoria. Is the price right? Will it set a new bar for prices paid by Chinese investors? Liu Lian reports from New York

Beijing-based Anbang Insurance Group made a big splash last month when it agreed to buy New York City's iconic Waldorf Astoria hotel for $1.95 billion from Hilton Worldwide Holdings Inc, the largest sale ever of a US hotel.

When the Blackstone Group - Hilton's majority shareholder - was approached by potential bidders a few months ago, sources said valuation experts put an estimate of $1.2 to $1.3 billion on the property. The sources declined to be identified by name. Blackstone declined a request for comment.

Did privately held Anbang, China's eighth-largest insurer, overpay for the Waldorf? What does the deal mean for future Chinese investments in the US real estate market? And could the swarm of Chinese real estate deals announced in New York over the last two years experience the same fate that happened to the Japanese real estate binge of the 1980s?

Banks tend to be on the conservative side when it comes to property valuations, said Michael B. Margolis, a partner at Blank Rome law firm and based at its Los Angeles office. "Their interest is more focused on protecting the bank's loan rather than assessing opportunities looking up for an asset," he said.

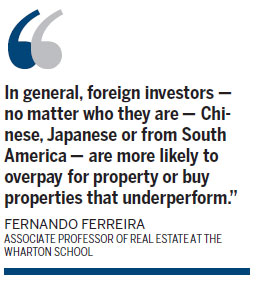

"In general, foreign investors - no matter who they are - Chinese, Japanese or from South America - are more likely to overpay for property or buy properties that underperform," said Fernando Ferreira, associate professor of real estate at the Wharton School. "Real estate is very local. You really need to know the market block by block. Almost by definition, no local investors have less knowledge or do worse about the local market than foreign buyers."

Anbang also has committed to a major renovation of the hotel, which may ratchet up to $400 million to $500 million, according to sources who asked not to be named. That, would bring the total acquisition tab to approximately $2.5 billion.

"Considering the brand recognition and the quality of the asset, I definitely think the Waldorf is a fair value in terms of what they are paying," said Marisha Clinton, director of research of capital markets at New York- based Jones Lang LaSalle (JLL) Property Consultants. It's a matter of supply and demand, she said.

'Unique opportunity'

"The Waldorf is a unique opportunity, not only because it's a five-star luxury hotel that encompasses an entire city block in Midtown Manhattan, but also because the project involves redeployment and repositioning of the asset," said Daniel Lesser, president and CEO of New York-based LW Hospitality Advisors. "The mere fact that it's a scarce opportunity is going to put upward pressure on value evaluation."

Gabriel R. Hungerford, a senior research analyst at Los Angeles-based CBRE Global Research and Consulting, called the Waldorf "one the most-prized pieces of real estate properties in modern American history."

"It's really one of the most stable investments they can make," he said. "Anbang is mostly likely motivated by diversification and capital preservation rather than purely by returns."

The Wall Street Journal calculated that Anbang is paying about $1.4 million per room. Margolis said Anbang is paying a little bit higher, but not a great deal higher than paid for other first-class properties.

By comparison, in January of this year Starwood Hotels & Resorts Inc sold the 207-room St. Regis Bal Harbour Resort in Miami for $213 million to Qatar-based Al Rayyan Tourism Development Company, making the per room rate approximately $1.03 million.

The Standard Hotel in lower Manhattan's Meatpacking district was purchased in February for more than $400 million by a group of investors, which represented at least $1.2 million a room.

The Plaza Hotel, another trophy in Manhattan, was bought by Indian billionaire Subrata Roy, head of property empire Sahara Group, for $2 million per room in 2012, according to hotel data tracker STR Analytics. The Sultan of Brunei recently acquired the hotel's mortgage, according to a source who asked not to be identified and who declined to give the amount of the mortgage.

To some observers, the Waldorf deal recalled Mitsubishi Company's $2 billion purchase in 1989 of Rockefeller Center, another New York landmark. The building complex was valued at $6 billion when acquired and fell to $1.5 billion when Mitsubishi exited the deal six years later, said Ferreira.

Other acquisitions in the Japanese real estate binge of the 1980s included the Tiffany building, Universal Studios and Columbia Records. All were subsequently sold at great losses.

The fallout from the Japanese meltdown two decades ago warrants caution for Chinese investors, experts said.

"I think most deals we saw before in real estate by Chinese companies were priced at the upper end," said Thilo Hanemann, director of research on cross-border investments for the Rhodium Group, "People have said that they cannot make a lot commercial sense of the evaluations."

"The Chinese and the Japanese period only looked the same on the surface. The Chinese government over the past 20 to 25 years has built up enormous financial strength and enormous financial reserve. And its policy is now to diversify and encourage outbound investment. The Waldorf deal is a good example of how the policy is implemented," said Daniel M Cashdan, head of investment banking at HFF Securities LP.

"The Chinese are not only buying landmark buildings. They are also doing developments, and investing not only in first-tier but second-tier cities," he said, "the Chinese investors are coming to the US with a much broader approach which will make the total results safer."

"The Japanese spree was really hindered by the flowing of the US economy, of the recession in the early 1990s. Their fall was not necessarily as a result of bad investments," said Hungerford.

Similarities with Japanese

"There are a lot of similarities between what's happening for Chinese investors and what happened for the Japanese in late 1990s," said Jonathan J. Miller, president and CEO of Miller Samuel Inc, a New York-based real estate consulting firm. "There's a similar feel to that now, although I don't know the difference on individual bases."

"One of my favorite saying is by Mark Twain. 'History does not repeat itself, but it often rhymes,'" said Miller.

With volatility in financial market challenging economic conditions worldwide, the New York market has become a global safe haven for investors, said Miller.

"Whether it is local, meaning domestic or foreign buyers of hard assets, everybody is scrambling for the highest quality assets they can find," he said. "I don't think it's unique to foreign investors. The foreign investor element in terms of participating in the market and paying premiums is greatly exaggerated."

Price development has been so rapid in Manhattan over the last two decades, said Hanemann. "If you go back 20 or 30 years, if you would have told someone what an office tower these days goes in Manhattan, they would have said you are crazy," he said.

"Anbang sells life insurance policies. The liabilities will persist for decades. If you buy Anbang insurance today, as you probably will have a life expectancy maybe over 70 years, Anbang will be prepared to have assets to pay for that liability very far in the future," said Margolis. "Naturally there is a horizon for investing, and it will also be very long. It makes sense for them to be investing in long term assets."

Anbang entered into a long-term management contract with Hilton that allows it to operate the Waldorf for the next 100 years.

"That's a reflection of a very long-term investing horizon," said Margolis, "in that background, what may be viewed as a premium paid for trophy properties may not be that huge a premium if it is being amortized over decades."

"There are foreign investors that do hold those properties for a long period of time. They are not buying and trading them right away. You are more than likely able to extract values not only on the appreciations, but also under the recurrent revenue measures as well," said Clinton.

"Another question to ask is what the alternatives are for the Chinese investors," said Ferreira, "perhaps, the alternative is to construct another hotel in China? From a portfolio perspective, maybe they are willing to pay a little bit more in order to get the safety of the Manhattan market."

In Global Housing Watching released in October, the International Monetary Fund reported that in large cities in China, house prices showed signs of overvaluation despite government measures to restrict speculative demand, whereas many smaller cities experienced oversupply.

"By some measures, year-on-year, 2014 over 2013, there's been a significant drop of more than 20 percent in the total dollar invested in the Chinese real estate market whereas in the US, there's an increase," said Margolis.

David Colen, managing director at Newmark Grubb Knight Frank, said yields in New York for stabilized, well performing assets ranged from 4 percent to 4.5 percent depending on asset class, whereas yields in other mature markets such as London, Hong Kong and Singapore may be more compressed.

"There's also the question of domestic uncertainly, including things that may not directly affect the financial market but affect it indirectly, such as the extent of the well-known anti-corruption campaign, food safety issues and environmental challenges," said Margolis.

All those factors are playing against the background of the central government encouraging outbound investments. In the insurance industry, since 2012, the China Insurance Regulatory Commission (CIRC) has increased investment options for Chinese insurers. They are allowed to trade index futures and derivatives in the domestic market and bans on investing abroad have been lifted.

Starting in February, the CIRC allowed Chinese insurance companies to invest up to 30 percent from 20 percent of their total assets to real estate. The ceiling for overseas investment also was increased to 15 percent of total assets.

Ping An, China's second-largest insurer, bought the Lloyd's Building in London in July 2013 for $388 million (260 million pounds). In June, China Life, the world's biggest insurer by market capitalization, took a 70 percent stake with Qatar Holding, a sovereign wealth-fund subsidiary, and paid $1.4 billion (795 million pounds) to acquire 10 Upper Bank Street in London from Canary Wharf Group.

Anbang's ranking

As of September 2014, according to the CIRC website, Anbang was ranked 17th among Chinese property insurers and 35th among life insurance companies based on this year's premium income.

In May, the CIRC approved Anbang to increase its registered capital of $2.95 billion (18 billion yuan), $1.31 billion (8 billion), and $1.64 billion (10 billion), respectively, in the parent group, life insurance unit and property insurance unit. It made the total registered capital in the three entities to $4.91 billion (30 billion), $1.93 billion (11.79 billion), and $3.11 billion (19 billion), respectively.

The registered capital of Anbang property insurance is the largest among peers, far ahead of Ping An's $2.78 billion (17 billion).

Premiums in Anbang's life insurance represented 8 percent of assets by end of 2013, compared with 16 percent at China Life. "That suggests Anbang is using equity capital, rather than premiums, to finance its purchases," the Financial Times reported.

One week after the Waldorf acquisition, Anbang reached an agreement to acquire Belgian insurer Fidea from US private equity firm J.C. Flowers & Co for an undisclosed amount. The deal must be approved by the National Bank of Belgium.

Although renovation plans for the Waldorf Astoria have not been released, many speculate that Anbang may convert part of the hotel into condos.

"While the Waldorf is positioned to be a 'luxury' facility, it is a challenge to operate in such a manner with an inventory of 1,413 guest units, price development has been so rapid in Manhattan over the last two decades," said Lesser.

"Tremendousvalue creation opportunities exist to significantly reduce the size of the hotel and create luxury residential as well as high-end retail on the ground floor of the property."

There is no city regulation restricting condo conversion or the percentage of a conversion, according to Jonathan H. Canter, a partner at New York-based Kramer Levin Naftalis & Frankel LLP, who represented El-Ad Properties in the conversion of the Plaza.

Anbang's agreement with the Hilton does not affect the number of rooms under its management, according to people familiar with the matter.

The Plaza Hotel is an example of the redevelopment opportunity that exists for the Waldorf, said Lesser. The 100-year-old, 805-room Midtown hotel was closed in 2005 and reopened in 2006 with about 150 hotel rooms, 200 condominiums and a retail section. Buyers had closed on nearly 100 of the condo conversions within weeks, according to media reports.

There are 18 apartments at the Plaza now listed for sale, according to data provided by CityRealty, at an average price of $4,126 per square foot.

"Luxurious apartments in New York are highly sought after among Chinese and wealthy Americans and foreigners from Brazil to Ukraine," said Lesser.

JLL confirmed the condo version trend as one of the three key predictions for 2015. It reported that the trend had taken hold of New York City with new condo projects selling for $2,000 per square foot in the Financial District to more than $8,000 per square foot near Central Park.

"If that's what Anbang chooses to do, that's a great idea," said Clinton.

There are also values that the Chinese investor could create, said Hanemann. "If they can generate a lot of businesses through their local Chinese connections or positions in the Chinese market, say, for example, the Waldorf is running at 60 percent capacity, and the owner is able to get it up to 95 percent capacity by bringing in a lot of wealthy Chinese guests, then the high evaluation would potentially make sense."

Occupancy rates

The occupancy rate of the Waldorf was not available. But the average occupancy rate for all Manhattan hotels in this year's second quarter compiled by PwC showed a 3.3 percent increase to 91.6 percent. The average occupancy rate for Manhattan luxury hotels was 87.8 percent; and for hotels on Midtown East, where the Waldorf is located, was 91.9 percent.

As for Chinese travelers to the US, the Office of Travel and Tourism Industries forecast in October that arrivals from China would increase to 2.24 million this year.

"You have a lot tourism coming to the area. At that specific hotel, you have a lot of diplomats staying there like the American ambassador to the United Nations," said Clinton, "Anbang is at a great position to make their return target."

On upgrading the Waldorf, Colen said "there are significant demands with the food and beverage business there which can use some updates," and he said perhaps, the Waldorf can introduce a food hall like the Plaza.

The Plaza Food hall launched in 2010 has been deemed a huge success for its European-style market offering of an extensive array of eateries, and has become a main attraction for locals and tourists.

"Committing to a major renovation alone would involve a whole construction process, selecting contractors, insurance for example. All these can be difficult water for foreign investors who are not versed in the domestic legal climate," said Margolis, the difficulties as such were plenty during the Japanese real estate spree in the 1980s.

Anbang has not yet revealed a funding plan for the Waldorf's acquisition. "Since Anbang is an insurance company, I would assume they use assets on the management from the insurance fees that they collected. Maybe they will bring some partner," said Hanemann.

Companies like to announce big numbers, said Hanemann, "but you have to be careful to take those numbers on a face value. You also have to consider that a lot of these deals are using local financing. There have been several multi-million dollar projects that were announced by Chinese investors over the past 18 months. We have to wait and see how much those projects are actually materialized."

Financing has been an issue for some Chinese projects, said Hanemann, with companies not able to raise funds within the time that they were expected to.

"If Anbang encounters any financial stress, it becomes a problem when they need to sell the property," said Ferreira, "when you need to sell in the situation of stress, that's when you realize you were overpaying."

Contact the writer at lianliu@chinadailyusa.com

|

The Waldorf Astoria is pictured at 301 Park Avenue in New York on Oct 6. Hilton Worldwide Holdings Inc said it would sell its flagship Waldorf Astoria New York hotel to a Chinese insurance company for $1.95 billion, one of the highest prices per room ever paid for a US hotel. Guan Liming for / China Daily |

(China Daily USA 11/14/2014 page20)

- S. Korea to hold drill in islets disputed with Japan: Seoul

- China, Pakistan pledge to strengthen air force cooperation

- B20 urges G20 to make bold commitments for growth, jobs

- Britain to introduce tough new foreign fighter laws

- World's tallest man meets world's shortest man

- Lang Lang honored with German award

Across Canada Nov 14

Across Canada Nov 14

Premier Li pledges to strengthen cooperation with India

Premier Li pledges to strengthen cooperation with India

Lang Lang honored with German award

Lang Lang honored with German award

Airshow China soars to success in Zhuhai

Airshow China soars to success in Zhuhai

The most people dine on the beds

The most people dine on the beds

Dangling workers rescued from World Trade Center

Dangling workers rescued from World Trade Center

Long-term visas issued for China, US citizens

Long-term visas issued for China, US citizens

Long-term visas issued for China, US citizens

Long-term visas issued for China, US citizens

Most Viewed

Economy on path of steady growth[1]|chinadaily.com.cn

Gay sex poses HIV threat for youth|Society|chinadaily.com.cn

Japan to release videos of Chinese activists|Asia-Pacific|chinadaily.com.cn

Gay sex blamed for rise in young students with HIV/AIDS|Society|chinadaily.com.cn

More young adults living with parents|Americas|chinadaily.com.cn

Magazine seeks Guangzhou expat families to tour Fujian[1]|chinadaily.com.cn

World's longest sightseeing escalator awaits you in Central China[4]|chinadaily.com.cn

Dai Ethnic Group[1]|chinadaily.com.cn

Minmetals unit offers sponge city solutions for rainfall usage|Business|chinadaily.com.cn

Licenses revoked in anti-porn campaign|Society|chinadaily.com.cn

Editor's Picks

|

|

|

|

|

|

Today's Top News

US spying scheme targets Americans' cellphones

The Waldorf's hefty price tag

China, US to build milk-powder plant in Kansas

China, ASEAN set goal for upgrading FTA

Country pushes for code at South China Sea

Beijing wants to keep 'APEC blue'

US, China reach landmark pacts

Youth urged to get politically involved

US Weekly

|

|