China shifts how it tracks yuan's value

Updated: 2015-12-15 11:28

By Paul Welitzkin in New York(China Daily USA)

|

||||||||

New trade-weighted exchange-rate index launched

To keep the value of its currency flexible, China is altering how it measures the value of the yuan by moving from an exchange rate that relies on the US dollar to the currencies of its trading partners.

The China Foreign Exchange Trade System (CFETS) announced on Dec 11 that it had launched a new trade-weighted yuan exchange-rate index that measures the currency's strength relative to a basket of 13 foreign currencies, including the US dollar, the euro and the Japanese yen, according to the trade volume with China.

The US and Chinese economies are heading in opposite directions, said Sung Won Sohn, a professor of economics at California State University Channel Islands in Camarillo, California.

"As the US (is poised) to raise the interest rate, RMB (yuan) will depreciate. In order to keep RMB within the band, PBOC (People's Bank of China) would have to raise the interest rate hurting the (Chinese) economy. So, the government has decided to keep the value of RMB against the dollar more flexible. One way to do this is by pegging RMB against a basket of currencies justifying the depreciation," Sohn wrote in an e-mail.

The Federal Reserve - the US central bank - is scheduled to meet this week and is widely expected to raise interest rates for the first time in nine years. Higher rates and slower-than-expected growth in China may encourage investors to find places other than the mainland to invest their money.

"China wants to maintain a stable trade-weighted exchange rate. If the dollar keeps appreciating, China does not want to follow the dollar up," David Dollar, a senior fellow at the Brookings Institution's John L Thornton China Center in Washington, wrote in an e-mail.

"Compared with just one currency, a basket of currencies can better capture the competitiveness of a country's goods and services and better enable the exchange rate to adjust import, export, and investment activities and the balance of payments position," said the PBOC.

The yuan weakened to 6.4495 against the dollar on Monday, its lowest level since July 2011, according to the CFETS. The correction came after the Chinese currency had appreciated 2.93 percent against the dollar as of late November, compared with the end of 2014.

In the basket that the yuan will track, the dollar has the largest proportion, 26.4 percent, following by the euro at 21.39 percent, the Japanese yen at 14.68 percent, and 10 other currencies accounting for 37.53 percent.

"The weightings clearly show that China intends to get rid of the yuan's reliance on the dollar over time," said Huang Yi, head of foreign exchange trading at China Guangfa Bank in Shanghai, according to Reuters. "As such, the yuan's movements will be more market-oriented and rely on economic and financial fundamentals in the long run."

paulwelitzkin@chinadailyusa.com

(China Daily USA 12/15/2015 page1)

- Saudi Arabia announces 34-state anti-terror alliance

- Premier greets SCO leaders ahead of meeting

- Bus crashes in northern Argentina, killing 43 policemen

- California shooter messaged Facebook friends about support for jihad

- Obama says anti-IS fight continues to be difficult

- Washington's cherry trees bloom in heat wave

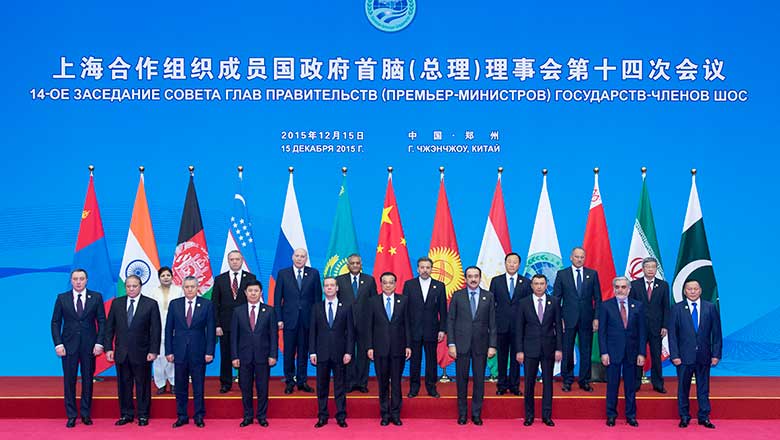

Leaders pose for group photo at SCO meeting

Leaders pose for group photo at SCO meeting

Washington's cherry trees bloom in heat wave

Washington's cherry trees bloom in heat wave

Wuzhen ready for Internet conference

Wuzhen ready for Internet conference

Fairy tale tunnel of love in south China

Fairy tale tunnel of love in south China

Beautiful moments of 2015 in China's great outdoors

Beautiful moments of 2015 in China's great outdoors

Student volunteers wear qipao for World Internet Conference

Student volunteers wear qipao for World Internet Conference

China marks Memorial Day for Nanjing Massacre victims

China marks Memorial Day for Nanjing Massacre victims

Six major archaeological discoveries in 2015

Six major archaeological discoveries in 2015

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

Islamic State claims responsibility for Paris attacks

Obama, Netanyahu at White House seek to mend US-Israel ties

China, not Canada, is top US trade partner

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

US Weekly

|

|