China's slowdown hits California

Updated: 2016-01-04 11:22

By Lia Zhu in San Francisco(China Daily USA)

|

||||||||

"The world's two biggest economies are so intertwined that if you catch a cold in China, it causes a big problem over here," said Kenneth Rosen, chair of the Fisher Center for Real Estate and Urban Economics at the University of California-Berkeley.

China has been going through a "tough transition" from basically a real estate and infrastructure investment boom to an economy based on consumption and personal services, he said.

The construction boom was "not happening much anymore, though it's still strong", Rosen explained. "So the linkages to the US economy come through clearly - exports and imports".

California, which sees China among its top three export markets, has reported a decrease in exports there this year.

According to a report by Beacon Economics in early December, a California-based economic research firm, shipments from California to China fell to $3.71 billion from August to October 2015 from $4.19 billion in the same year-ago period, an 11.4 percent drop.

California's exports to the Asia-Pacific region- led by computer and electronic products - dropped 2.1 percent during the same period, falling from $17.29 billion to $16.92 billion, a dip propelled largely by the drop in exports directly to China, according to the report's analysis of foreign trade data released by the US Commerce Department.

Not only exports, but also capital flows and people flows are affected, according to Rosen, who said that the Bay Area was in the middle of it.

"The Bay Area would be hurt if China's economy stumbled. It would come through the capital market, the debt market," he said.

There's been a big accumulation of corporate debt (either borrowed directly from financial institutions or the shadow banking system) in China to fund infrastructure and real estate, Rosen explained.

The second factor is that China was trying to stimulate the economy and get more investment by controlling the currency and lowering the exchange rate, he said.

"You can't do all those things, as we find in the US. Every time we try to do something, it goes bad," said Rosen, adding that the biggest issue China faced was how to let the air out of the currency, which was "too overvalued".

"So in order to keep their economy going, they (China) have to devalue the currency," he said. "They don't want to do it, as in August, which was a 4 percent instant change and shocked the system. But you want it to slowly devalue."

He also said that there were pressures that "some US people don't like that (devaluation of RMB), but it's the right thing to do. The currency is overvalued by about 15 percent," he said.

liazhu@chinadailyusa.com

(China Daily USA 01/04/2016 page1)

- Top planner targets 40% cut in PM2.5 for Beijing-Tianjin-Hebei cluster

- Yearender: Predictions for 2016 through 20 questions

- Asia's largest underground railway station opens in Shenzhen

- Shanghai bans drug-using actors, drivers

- Clamping down to clean up the air

- Yearender: Ten most talked-about newsmakers in 2015

- Over 1 million refugees have fled to Europe by sea in 2015: UN

- Turbulence injures multiple Air Canada passengers, diverts flight

- NASA releases stunning images of our planet from space station

- US-led air strikes kill IS leaders linked to Paris attacks

- DPRK senior party official Kim Yang Gon killed in car accident

- Former Israeli PM Olmert's jail term cut, cleared of main charge

127th Tournament of Rose Parade celebrated to embrace 2016

127th Tournament of Rose Parade celebrated to embrace 2016

Yearender: China's proposals on world's biggest issues

Yearender: China's proposals on world's biggest issues

NASA reveals entire alphabet but F in satellite images

NASA reveals entire alphabet but F in satellite images

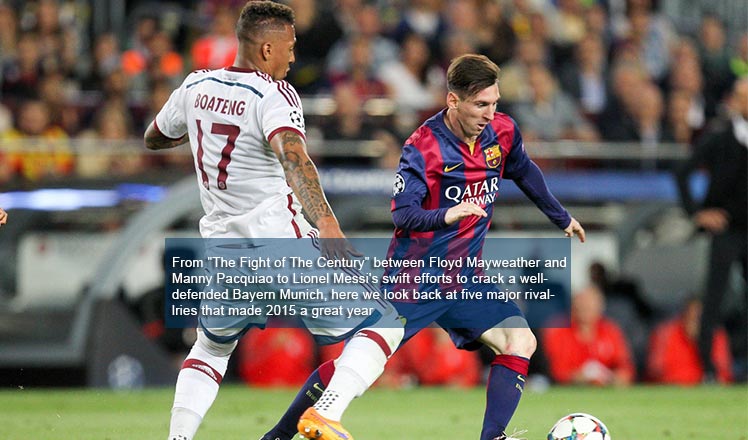

Yearender: Five major sporting rivalries during 2015

Yearender: Five major sporting rivalries during 2015

China counts down to the New Year

China counts down to the New Year

Asia's largest underground railway station opens in Shenzhen

Asia's largest underground railway station opens in Shenzhen

Yearender: Predictions for 2016 through 20 questions

Yearender: Predictions for 2016 through 20 questions

World's first high-speed train line circling an island opens in Hainan

World's first high-speed train line circling an island opens in Hainan

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

Islamic State claims responsibility for Paris attacks

Obama, Netanyahu at White House seek to mend US-Israel ties

China, not Canada, is top US trade partner

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

US Weekly

|

|