Effects of starting to end cheap money to be seen

Updated: 2015-12-18 07:42

(China Daily)

|

||||||||

|

|

Traders work on the floor of the New York Stock Exchange (NYSE) shortly after the announcement that the US Federal Reserve had hiked interest rates for the first time in nearly a decade in New York, Dec 16, 2015. [Photo/Agencies] |

The much-anticipated hike in interest rates announced by the US Federal Reserve on Wednesday represents a belated beginning to the end of super cheap credit.

Given the failures by other central banks to secure sustained growth while getting rid of the life-support system of easy credit, it is far too early to tell if the United States' end to its unprecedented massive monetary experiment to fight the worst global financial and economic crisis in many decades will mark a turning point for a successful exit from abnormally low borrowing costs.

Yet recent signs of the US economy recovering from the global financial crisis justify the Fed's decision to raise its benchmark interest rates by 0.25 percentage points after cutting them next to zero since December 2008. With its consumer spending growth holding firm and unemployment standing at 5 percent, the US economy is ostensibly better positioned than most other countries to withstand the withdrawal symptoms of ending its addiction to easy credit.

However, globally speaking, the hike in US interest rates will likely be a source of uncertainty as widely adopted loose monetary policies in many countries have been running out of steam and have failed to stop the world economy from falling back to the lowest level of growth since 2009.

Slowing global trade growth, depressed commodity prices and falling international investment have resulted in very sluggish growth for developing and transition economies this year. And there are concerns that the rise will aggravate this, as higher rates in the US could strengthen the dollar and kick-start more capital outflows from many developing economies in coming years.

But accommodative monetary policy stances worldwide have largely worked their magic in avoiding the worst-case scenario, so it makes no sense to continue relying on more such monetary policies instead of fixing the deep-rooted structural problems in different economies.

Therefore, though the ability of the US economy to withstand higher US interest rates and its impact on global growth remains questionable, the US Fed should not indicate any willingness to backpedal on the upward move of interest rates.

Otherwise, the current hike may end up as a false start to normalize borrowing costs.

- Yuan interest rate in HK hits 2-month high on funding crunch

- Interest rate wars unlikely as China frees bank deposit rates

- US Federal Reserve leaves key interest rate unchanged

- Analysis of Net Interest Margin Changes in China's Banking Sector against the Backdrop of Interest Rate Liberalization (No 112, 2015)

- Pandas prefer choosing their own sex partners, researchers find

- Tycoons exchange views on building a cyberspace community of shared future

- China successfully launches its first dark matter satellite

- Report: Layoffs may loom next year

- China launches satellite to shed light on invisible dark matter

- China strongly opposes US arms sale to Taiwan

- Good international coordination a must to combat terrorism

- Chinese embassy: spy report 'sheer fiction'

- US, Cuba agree on restoring commercial flights

- Fed raises interest rates, first rate hike since 2006

- IAEA decides to close nuclear weapons probe of Iran

- Russia, US call for common ground over issues

Canadian college offers flying classes to legless girl

Canadian college offers flying classes to legless girl

Fashion buyer scours the world for trendy items

Fashion buyer scours the world for trendy items

Tycoons exchange views on building a cyberspace community of shared future

Tycoons exchange views on building a cyberspace community of shared future

Snow scenery of Taklimakan Desert in Xinjiang

Snow scenery of Taklimakan Desert in Xinjiang

East China province gets 1st subway line

East China province gets 1st subway line

President Xi delivers keynote speech at World Internet Conference

President Xi delivers keynote speech at World Internet Conference

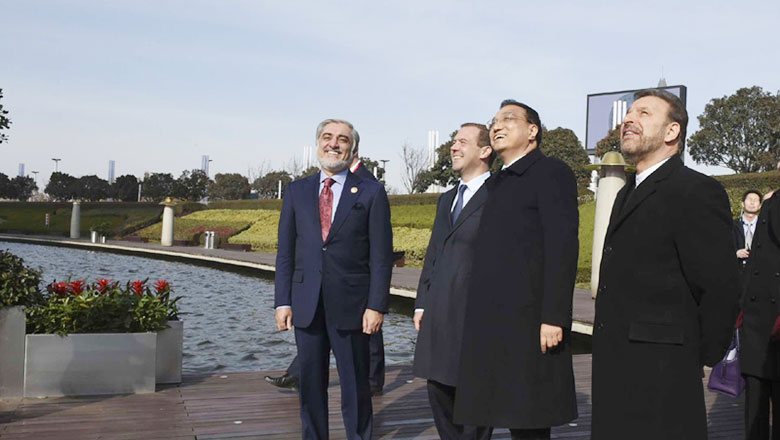

Chinese premier shows Zhengzhou's fast growth to SCO leaders

Chinese premier shows Zhengzhou's fast growth to SCO leaders

Two Chinese Antarctic expedition teams set off for Antarctic inland

Two Chinese Antarctic expedition teams set off for Antarctic inland

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

Islamic State claims responsibility for Paris attacks

Obama, Netanyahu at White House seek to mend US-Israel ties

China, not Canada, is top US trade partner

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

US Weekly

|

|