Auto industry roars through 2013

Updated: 2013-12-30 11:40

By Michael Barris in New York (China Daily USA)

|

||||||||

General Motors Co's decision to move its international head office to Singapore from Shanghai defined the year in the US-China automotive industry.

Announced in mid-November, the shifting of GM's "consolidated international operations" to Singapore amounted to GM breaking out a separate unit from its now much larger businesses in China and South Korea. The move, scheduled to take effect in the second quarter of next year, will allow the iconic Detroit automaker to shore up its position as the largest foreign automaker in China, which generates 30 percent of the company's sales and is its biggest market.

The company will retain 250 staff in Shanghai to oversee China, while 245 will stay in Seoul. The new Singapore headquarters will have about 120 employees to oversee GM's businesses in Africa, Southeast Asia, Australia, New Zealand, India, South Korea and the Middle East, as well as Chevrolet and Cadillac Europe, GM said.

"China is the world's largest vehicle market and it demands singular attention and focus for the company to remain a leader," GM told China Daily in an e-mail. GM said decisions about its international markets would now be made "in the interest of growing our business while allowing us to focus even more intently on China".

China, which overtook the US as the world's largest automotive market by sales in 2009, sold 19.1 million passenger vehicles in 2012. By 2020, the number is expected to rise to 33 million, according to analysts. GM's light vehicle sales in the country over the past five years have soared by an average annual rate of 27 per cent, from 1.1 million units in 2008 to almost 3 million in 2012.

GM's international operations division is the company's second-biggest generator of profit after North America. Last year, it had pretax profit of $2.19 billion on revenue of $27.69 billion. The North American unit had pretax earnings of $6.95 billion on revenue of $94.60 billion.

Michelle Krebs, Edmunds.com senior analyst, said the Singapore relocation will give GM's China operations "more autonomy" and "put more emphasis on other Asia Pacific operations like Thailand, where GM builds its global trucks, and up-and-coming Indonesia".

Stronger-than-expected demand from China is projected to boost auto sales globally next year. Moody's Investor Service in September forecast a 4.8 percent sales increase worldwide.

Another move that had the industry talking in 2013 was Tesla Motors' launch of its huge new Beijing showroom. Even as the world's largest Tesla dealership opened its doors with what the company said were dozens of buyers ordering its expensive electric cars, California-based Tesla was still waiting for the Chinese government to approve its import operation. Tesla product specialist Ma Li told China Daily that the delay could push back delivery of the cars in China into the New Year.

The company said in a release that it expected its first 100 cars for the China market to quickly sell out. It said it anticipates 20,000 sales in 2013 and twice that many next year.

Tesla's Model S sedan sells in the US for $70,000 to $100,000. Ma said the price in China for various models may range from 900,000 yuan ($146,000) to 1.2 million yuan ($195,500).

Some analysts said the car's acceptance by wealthy buyers could spur buying of electric vehicles in China, which has embraced alternative energy vehicles to combat severe smog problems in Beijing and other large cities.

Others, however, doubt Tesla can wring significant sales from China, given weak world demand for electric vehicles. Despite refocused attention on low-emission vehicles as a way to rid China of a hazard to both human health and the country's economy, sales have been limited to government and corporate customers.

Another US-China auto story that raised eyebrows during 2013 was the plan by Geely Automotive Holdings Co to start exporting cars co-developed with Sweden's Volvo Car Corp to the United States in two years.

US analysts gave the Chinese automaker's announcement mixed reviews. "I'm not convinced that US consumers are ready for a Geely-badged car in the US, even if it's on a Volvo platform," said David Sedgwick, an analyst and the former Automotive News editor. "It could blur Volvo's brand image in the US, and that would be bad news for the Swedes."

Geely CEO Gui Shengyue said the automaker, which bought Volvo in 2010 from Ford Motor Co for $1.8 billion, would start exporting cars that it develops with the Swedish company to the US in 2015.

Geely, which made an unsuccessful bid to crack the US market several years ago, is betting that Volvo's reputation for safety and reliability can help it win buyers in developed nations at a time of slowing sales in China.

Just getting a car to the US market would be a huge accomplishment for Geely. The only Chinese-made vehicles now exported to the US are small trucks and off-road vans such as the Wuling Minimax, according to the American Association of Motor Vehicle Administrators.

Second blast kills 14 in Russian city

Second blast kills 14 in Russian city

F1 legend Schumacher in coma after ski accident

F1 legend Schumacher in coma after ski accident

Net result

Net result

Fire on express train in India kills at least 26

Fire on express train in India kills at least 26

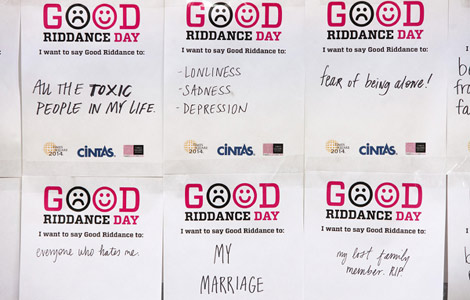

Times Square visitors purge bad memories

Times Square visitors purge bad memories

Ice storm leaves many without power in US, Canada

Ice storm leaves many without power in US, Canada

'Chunyun' train tickets up for sale

'Chunyun' train tickets up for sale

Abe's war shrine visit sparks protest

Abe's war shrine visit sparks protest

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese economy to overtake US later than thought

China an historic opportunity: report

Outrage still festers over Abe shrine visit

Suicide bomber kills 16 at Russian train station

Magazine reveals NSA hacking tactics

Pentagon chief concerned over Egypt

Broader auto future for China, US

Li says economy stable in 2014

US Weekly

|

|