Homes for the aged

Updated: 2013-05-10 07:10

By Sun Yuanqing (China Daily)

|

||||||||

Different stakes

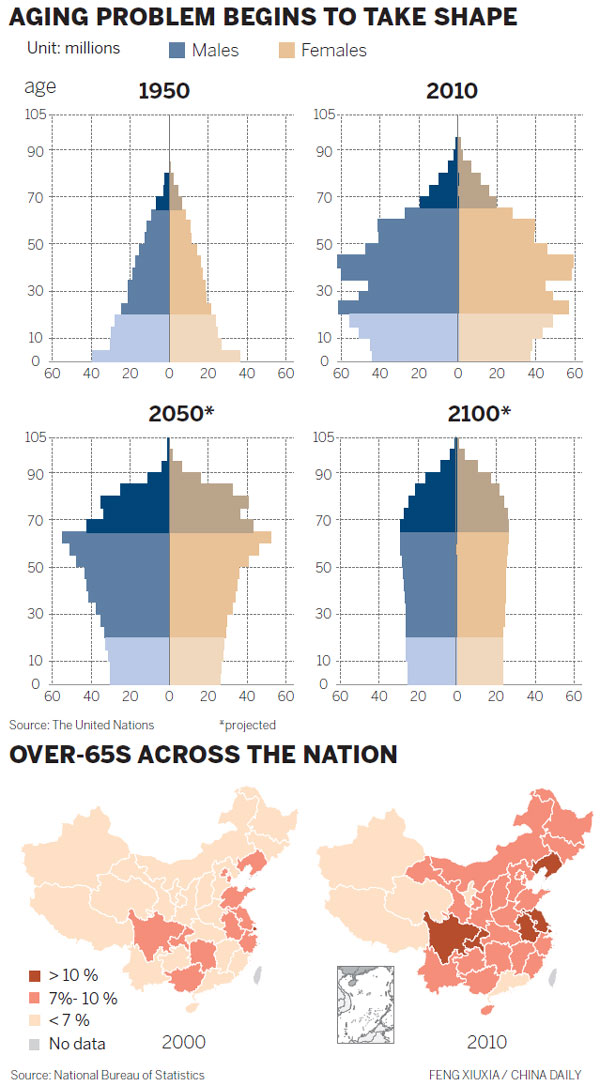

However appealing China's demographics may seem, its elderly, among all its populations, is the least willing to spend, according to a survey conducted by Yang from Tsinghua University.

"The GDP level in China is low and for old people, it's even lower. Among all the age groups, people between the age of 70 and 80 have the lowest consumption power and willingness to spend," Yang says.

That, however, has not deterred most of the prospective investors. In fact, it has prompted them to start from the very high-end services and then move on to the entire chain.

"If you look at the senior-care industry in an economy like China, it's clear that the demographic need is real. But it's also not clear whether the Chinese are going to access senior care in the same way as we have in the West," says Benjamin Shobert, founder and managing director of the Seattle-based consulting firm Rubicon Strategy Group.

"So if you are an entrepreneur and you are trying to segment the market, it is better to focus on the least risky sector, which is the really high end. This is what has been driving most of the investment so far," he says.

Golden Heights, an assisted-living community in Beijing, was one of the communities that took the plunge in 2007 and has since reaped the rewards.

"We found that demand for senior-care services was huge, but the average amount most customers were willing to pay was less than 1,500 yuan a month. That's why we decided to start from developed regions like Beijing, Hangzhou, Shanghai and Haikou," says Gao Junsong, general manager of Golden Heights.

The company invested about 580 million yuan in a facility in Beijing and another one in Hainan. The facility in Beijing charges more than 10,000 yuan a month and has an occupancy rate of 10 percent after just four months of operation. Most of its residents are retired government employees with welfare benefits and hence have few financial concerns.

As operators focus on high net worth individuals, the market for the middle class still remains largely untapped. But that could be exactly where the largest demand will be coming from, analysts say.

"There is no doubt that a lot of Louis Vuitton purses are being sold in China, but at the same time there is also a growing social need for elderly care services among the middle class," Shobert says.

"That's a much more stable and accessible part of the market. If you look at the success stories of US brands in China, you will find that some of them are luxury products, but a lot of them are young brands which figured out a way to really talk to and deliver a solution for the Chinese middle class," he says.

While a viable business model with the middle-income segment of the market is yet to appear, that does not mean it never will.

China Senior Care, a US company, is developing a 64-bed five-star senior community in Hangzhou. It is also considering expanding into the middle-class market by extending its product line.

"With a five-star brand, we want to offer world-class quality of service and care. But ultimately, we will work on our four-star brand and three-star brand," says Mark Spitalnik, founder, president and CEO of CSC.

"Like the hotel business, we will focus at the top of the chain, but ultimately I think there would be a demand for four and three-star products as well," he says.

Hand in hand

For the moment though, most of the foreign companies have decided to piggyback on a local partner to tap into the Chinese senior care and housing industry.

Cascade Healthcare, a Seattle-based joint venture between Columbia Pacific Advisors and Emeritus Corp, opened its first healthcare facility in Shanghai in January. The company is setting up another joint venture with Sino-Ocean Land, a Chinese real estate developer, for a new branch in Beijing that is slated to open in July. The investment in the new unit is estimated to be around 40 million yuan.

While Cascade dominates the management process, it says it is in no hurry to go independent.

"The management model we brought in from the US needs to be localized and a good partner can help us with that. Sino-Ocean Land has upmarket assets and has first-hand knowledge about upmarket consumers, which can help us localize our product," says Serena Xie, managing director of Cascade Healthcare.

The company also integrated TCM treatment to its original care model to cater to the preferences of the elderly.

For Chinese companies starting from scratch, the Western expertise is more than handy, just as much as their Western counterparts need local knowledge.

Vcanland, a real estate developer in Tianjin, decided in 2010 to shift its focus from traditional real estate to senior care and housing, in the hope of being a leader in a market that had very few players.

"There was a leading role in every segment of the real estate market except the senior housing sector. Everyone started from zero, and that makes it possible for us to be the leader," says Wei Song, CEO of Vcanland Senior Living Group.

However, the company realized that it would be unable to realize its ambitions without help from a foreign partner. It teamed up with the Tucson, Arizona-based Watermark Retirement Communities, to create a platform that includes everything from senior dining, amenities, security and acuity healthcare for Chinese seniors.

|

Gao Junsong, general manager of Golden Heights, says demand for senior-care services is huge. Sun Yuanqing / China Daily |

Wei says: "Simply put, we want to play a role in the senior-care industry just like what Marriot is to the hotel business, a distinguished management company. China doesn't have one so far, but will soon have."

The company has hired more than 10 professionals from the US, Hong Kong and Taiwan, and expects to turn their know-how into their own business model.

It is going to open a dementia care center in Tianjin and two assisted-living facilities in Shanghai within two years. It has also bought a slot of land in downtown Shanghai to build a retirement community.

Michelle lays roses at site along Berlin Wall

Michelle lays roses at site along Berlin Wall

Historic space lecture in Tiangong-1 commences

Historic space lecture in Tiangong-1 commences

'Sopranos' Star James Gandolfini dead at 51

'Sopranos' Star James Gandolfini dead at 51

UN: Number of refugees hits 18-year high

UN: Number of refugees hits 18-year high

Slide: Jet exercises from aircraft carrier

Slide: Jet exercises from aircraft carrier

Talks establish fishery hotline

Talks establish fishery hotline

Foreign buyers eye Chinese drones

Foreign buyers eye Chinese drones

UN chief hails China's peacekeepers

UN chief hails China's peacekeepers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shenzhou X astronaut gives lecture today

US told to reassess duties on Chinese paper

Chinese seek greater share of satellite market

Russia rejects Obama's nuke cut proposal

US immigration bill sees Senate breakthrough

Brazilian cities revoke fare hikes

Moody's warns on China's local govt debt

Air quality in major cities drops in May

US Weekly

|

|