Some less content with auto services

Updated: 2012-07-31 11:20

By Li Fangfang (China Daily)

|

||||||||

|

|

|

Cars damaged by recent flooding at a maintenance center in Beijing's Fengtai district. [Photo/China Daily] |

After increasing for six years in a row, customers' satisfaction with the after-sales service they receive from dealers in China dropped in 2012, according to the JD Power Asia-Pacific 2012 China Customer Service Index Study.

Analysts said the decline was a reflection of the industry's inability to keep pace with annual increases in sales. In the past four years, nearly 40 million new passenger vehicles have been added to China's roads.

"Facing the challenges, a mind shift is required for automotive dealers," said Charles Mills, vice-president of global retail practice with the marketing information services company JD Power and Associates.

"They need to optimize their strategy with rethinking strongly about after-sales service, financing, as well as used automobiles - not only about new vehicle sales."

"China's after-sales service market has more potential than the still growing new-vehicle market over the next few years. As a result, after-sales service is becoming one of the backbones for dealers to sustain growth amid fierce competition."

Mills said the survey also suggests that sales of new vehicles in China are producing lower profits as the market for such vehicles weakens. At the same time, the profits that can be made from after-sales services are increasing.

And his confidence in the after-sales market is also coming from his experiences in long-standing automobile markets, such as the United States'.

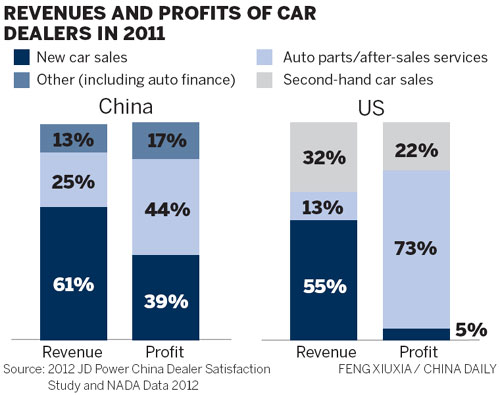

"After years of development, now in the US, 73 percent of the profits for automotive dealers are coming from after-sales services and 5 percent are contributed by new vehicle sales, while after-sales services in China only account for 44 percent of dealers' profits, and 39 percent from new vehicle sales," Mills said.

The study, now in its 12th year in China, attempts to measure how satisfied vehicle owners feel after they have visited an authorized dealer's service department to obtain maintenance or repair work for a vehicle they have owned for between 12 and 24 months, which often makes up a substantial portion of a vehicle's warranty period.

Customers' general satisfaction with dealer service in China declined to 832 points on a 1,000-point scale in 2012, down from 833 points in 2011. Dealers that sell Japanese brands were among those that garnered the top three rankings.

Based on a JD Power analysis, the number of vehicles on the road in China may be increasing faster than the industry can add qualified dealers that are capable of servicing those vehicles according to the standards that consumers expect.

To keep pace with the growing demand for passenger vehicles over the past few years, automakers in China have aggressively expanded their dealer networks. In 2011, the number of authorized dealers increased by 14 percent year-on-year, according to JD Power.

Moreover, despite that increase, service advisers employed at those places are receiving 10 percent more customers on average, thus putting dealers under great pressures.

"Our research has shown that customer satisfaction with the dealership has a significant impact on owner loyalty and brand advocacy," said Justin Min, senior automotive analyst for JD Power Asia-Pacific Shanghai.

"Providing high levels of customer service among an increasing number of new dealerships with higher sales volumes is clearly a challenge," Min said. "Those brands that can successfully manage this expansion will be better positioned for growth as the industry evolves."

lifangfang@chinadaily.com.cn

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|