Meltdown 2.0 led by China selloff, again

Updated: 2016-01-08 11:52

By Paul Welitzkin in New York(China Daily USA)

|

||||||||

Thursday was Monday all over again for global stock markets.

For the second time in a week, stocks slumped sharply across the world on Thursday precipitated by heavy selling in China as officials in the mainland pulled the plug on a mechanism designed to limit chaotic market activity.

The year got off to a rocky start on Monday when a stock selloff in China quickly spread to other markets as investors weighed lower-than-expected growth prospects in China along with a falling yuan and sliding oil prices. The same scenario unfolded today as Chinese stocks plunged by more than 7 percent, forcing officials for the second time this week to implement a so-called "circuit breaker" and halt trading for the day.

Later the Shanghai and Shenzhen stock exchanges said China would suspend use of the circuit breaker as of Friday.

Kenneth Kavajecz, dean of the Whitman School of Management at Syracuse University in Syracuse, New York, said circuit breakers are set up to calm the markets "but research has shown that in fact it can have the opposite effect by making traders fearful of not being able to get out of their positions. Thus, they clamor to liquidate their positions, not unlike yelling 'fire' in a crowded theater," he told China Daily in an e-mail.

Jian Yang, a professor of finance at the University of Colorado Denver campus, said because of higher economic uncertainty, emerging markets like China are likely to experience added volatility which means the Chinese exchanges are more likely to reach the 7 percent threshold more frequently than in developed markets like the US.

Yang said there are some important factors about Chinese investors that might make circuit breakers less effective in the mainland.

"The Chinese stock market is primarily (estimated to be 70 to 80 percent) composed of individual investors rather than institutional investors as in the US. (They) would be far more vulnerable to the so-called herding effect or following the crowd. Even though circuit breakers are meant to give investors time to sell stock calmly, or even buy back stock if they deem prices are too low, the majority of Chinese investors just follow the crowd to dump stocks in a panic due to a lack of their own assessment of information," Yang said in an e-mail.

These and other reasons suggest that the Chinese stock market exhibits a much higher liquidity risk and higher liquidity discount, and even if the 7 percent circuit breaker works in other developed markets, it is likely too low for China, Yang said.

Are there other regulatory measures China should consider besides a circuit breaker?

"A market needs to be able to find the equilibrium price (and) constraints that hamper that price discovery simply amplify and extend the uncertainty. Except in very extreme circumstances, markets should be allowed to operate unfettered," said Kavajecz.

"China should focus on improving its design of regulatory measures by paying close attention to the unique features of its financial markets and investors and also learn from the history of similar regulations from other countries," added Yang.

Another factor that may have contributed to the market selling is China allowing the value of its currency, the yuan, to decline in part to make its exports more competitive.

"It is an important contributor to the current decline as market participants infer that the Chinese economy is much weaker than previously thought," said Kavajecz.

"Some international investors might interpret the rapid depreciation of the yuan as a signal of inside information about a less optimistic outlook for the Chinese economy in the near future," added Yang.

In the US, the Dow Jones Industrial Average lost 392.41 points on Thursday to finish at 16,514.10. Markets in Europe and Latin America were also down sharply. In China, the CSI 300 Index of large-capitalization companies fell 245.42 to 3294.38.

paulwelitzkin@chinadailyusa.com

|

Investors kill time at a trading floor in the Dongzhimen area of Beijing by playing cards on Thursday morning, after trading on the Shanghai and Shenzhen stock exchanges halted. Cao Boyuan / for China Daily |

- Obama says US must act on gun violence, defends new gun control rules

- Over 1 million refugees have fled to Europe by sea in 2015: UN

- Turbulence injures multiple Air Canada passengers, diverts flight

- NASA releases stunning images of our planet from space station

- US-led air strikes kill IS leaders linked to Paris attacks

- DPRK senior party official Kim Yang Gon killed in car accident

Special report: Rise and rise of China's outbound tourism

Special report: Rise and rise of China's outbound tourism

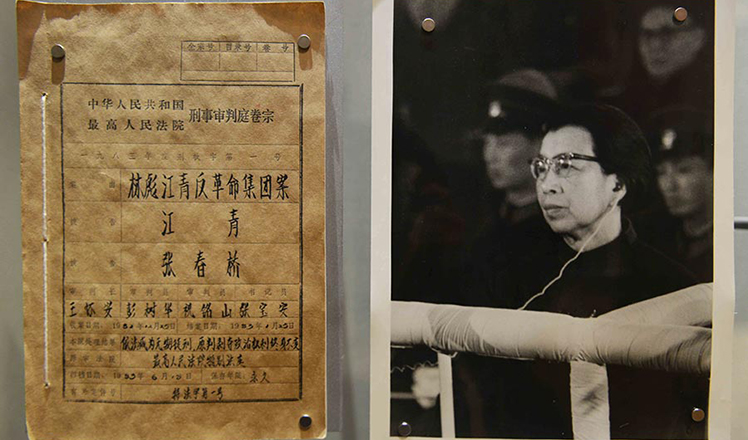

Trial data of former senior Party officials on display

Trial data of former senior Party officials on display

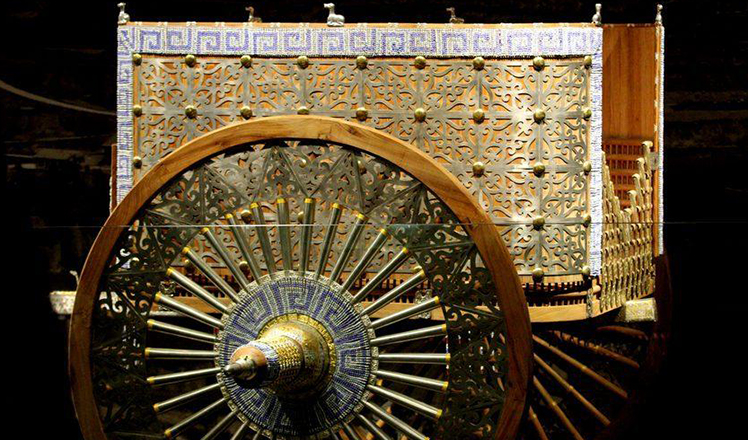

Replica of luxurious chariot from ancient times wows Xi'an visitors

Replica of luxurious chariot from ancient times wows Xi'an visitors

Number of giant pandas in China reaches 422

Number of giant pandas in China reaches 422

Attendees feel the thrill of tech at CES trade show

Attendees feel the thrill of tech at CES trade show

Vivid dough sculptures welcome Year of the Monkey

Vivid dough sculptures welcome Year of the Monkey

Kidnapped five-year-old reunites with her family 56 hours later

Kidnapped five-year-old reunites with her family 56 hours later

Kung Fu Panda hones skills from master

Kung Fu Panda hones skills from master

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

Islamic State claims responsibility for Paris attacks

Obama, Netanyahu at White House seek to mend US-Israel ties

China, not Canada, is top US trade partner

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

US Weekly

|

|