2012 trade deficit is likely, say economists

2012-01-10 08:10:46

China is likely to face a trade deficit in 2012, partly driven by the deteriorating eurozone crisis.

Tough time as demand contracts

2012-01-10 09:58:26

Most Chinese businesses will face the toughest time this year since 2000, according to a think tank.

80% of CEOs optimistic: survey

2012-01-10 09:39:42

The CEOs of leading privately-owned companies are expecting improvements in business growth in 2012.

Securities market reforms to advance

2012-01-10 09:37:47

China's top securities regulator said Monday it will advance reforms in 2012 to make the capital market better serve the real economy.

Culture is new growth source

2012-01-10 09:35:45

As the global financial downturn worsens, China is looking to its cultural industry for stimulus to shore up its slowing growth and to sustain its economic restructuring.

Home price falls to continue

2012-01-10 09:27:24

Property prices will continue to decline in the first half of the year before gradually stabilizing.

Property prices will continue to decline in the first half of the year before gradually stabilizing.

Measures to boost financial markets

2012-01-10 07:30:02

Financial markets will be developed and the securities industry opened further to foreign participants in a bid to diversify risk in the banking sector.

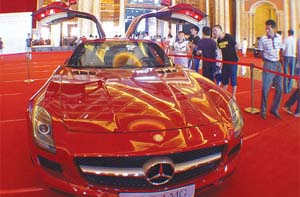

China market retained auto sales crown

2012-01-09 09:55:29

After two years of explosive growth, China's auto market cooled in 2011 as government tax rebates for small cars, trade-in subsidies and incentives for rural buyers expired.

After two years of explosive growth, China's auto market cooled in 2011 as government tax rebates for small cars, trade-in subsidies and incentives for rural buyers expired.

Builders follow environmental approach

2012-01-09 09:46:44

Government and business leaders see the need but costs remain a high priority for most developers.

Government and business leaders see the need but costs remain a high priority for most developers.

The right chemistry for pharma firms

2012-01-09 09:40:07

BMS is not the only international drugmaker actively seeking R&D cooperation with Chinese companies.

BMS is not the only international drugmaker actively seeking R&D cooperation with Chinese companies.

Yum! takeover proposal approved

2012-01-09 09:33:14

Shareholders of China's leading domestic hot pot chain, Little Sheep Group Ltd (Little Sheep), have approved a takeover proposal by Yum! Brands Inc (Yum!), Yum!

Tourists flocking to neighbor

2012-01-09 07:37:46

Lu Na thinks that the 4,000 yuan ($630) she spent on traveling to the Republic of Korea (ROK) was worth every penny.