Conquering the seven seas

Updated: 2016-08-20 01:04

By WANG YING in Shanghai(China Daily USA)

|

||||||||

In a move to secure steady growth in the future, China's leading fishing conglomerate is eyeing steady expansion into overseas markets while boosting its domestic offerings

|

|

Pu Shaohua, president of Shanghai Fisheries General Corp, believes Chinese consumers will eventually be open to trying new products such as canned tuna because of its nutritional value. PROVIDED TO CHINA DAILY |

Shanghai Fisheries, one of the top players in China by fishing volume, was among the first batch of companies that developed overseas deep sea fisheries as early as 1985. To date, the Shanghai-based group has become a market leader with the most advanced fishery equipment and facilities in the Chinese mainland.

According to Pu, Shanghai Fisheries currently account for more than half of the skipjack tuna output by Chinese fishing fleets.

Except for a 10-year gap between 2002 and 2012 when he worked at the municipal government's commerce and trade divisions, the 46-year-old Shanghai native has been working at Shanghai Fisheries since he graduated in 1991.

"In the 1990s, I worked in Africa as Shanghai Fisheries had a base of operations there. Based on my experience and having witnessed the development of Shanghai Fisheries, I have recognized that further development of the company lies in placing equal emphasis on its overseas and domestic markets," said Pu.

In line with the objectives of China's One Belt One Road initiative, Shanghai Fisheries is planning for a robust expansion of its overseas business and will also be bringing new products into the domestic market to provide Chinese consumers with more diversity in their food choices.

Pu added that the group's goal is to integrate the nearly 30 brick-and-mortar shops, convenient stores and supermarket partners with e-commerce platforms, hotels and restaurant customers so as to provide the domestic market with top quality products at reasonable prices.

"We plan to hit about 300 million yuan ($45.23 million) in annual sales in the domestic market within five years. At the same time, we will be expanding our fishing operations to all seven seas by 2020," said Pu.

The total amount of imported sea products by Shanghai Fisheries soared from 15,000 tons in 2011 to 72,000 tons in 2015, and about half of their fishing output were shipped back to the Chinese market as of last year.

To date, more than 90 percent of Shanghai Fisheries' revenue is generated through its core business in fisheries. The group's fishing business has established a presence in more than 10 countries in South America, Africa, Oceania and Antarctica.

"A strong focus of the fishing industry is on maintaining our output at a reasonable level, so that fishing resources can be sustainable," said Pu.

"Deep sea fishing is highly dependent on the weather, local environment and policies. As a result, Shanghai Fisheries has made a series of efforts to increase added value of its products, cultivate brands and expand the industrial chain to make itself stronger and experience stable growth," said Zhou Jianmin, an official from the Shanghai Municipal Agricultural Commission.

In the past two years, Shanghai Fisheries has been actively expanding its industrial chain to include processing, marketing and branding.

In April 2014, Shanghai Jinyou Deep Sea Fisheries Co, a subsidiary of SFGC, acquired Argentina's Altamare SA for $21.5 million cash. Through the wholly-owned Argentinian company, Shanghai Fisheries obtained four licensed shrimp fishing vessels, Altamare's brand, and a modernized processing plant.

"Through this purchase, Shanghai Fisheries gained an extra 10,000 tons in annual output, including $40 million worth of Argentine shrimp, cod and squid," said Pu.

According to him, the 2,800 tons of Argentine shrimp, mostly sold in Europe, enjoyed overwhelming demand in China during last year's Lunar New Year.

In June, Shanghai Kaichuang Ocean Resources, the listed arm of Shanghai Fisheries, continued with this expansion strategy by purchasing Spanish seafood company Conservas Albo for 61 million euros ($68.1 million).

With a history of more than 100 years, Conservas Albo had been managed by the same family for three generations. It is a market leader in Spain's fish processing sector and its premium canned fish is sold across Europe, America and Africa.

Pu said that the acquisition of Conservas Albo not only enables Shanghai Fisheries to obtain the brand, marketing channels and its modern food processing product lines, but also opens the door to exploring the overseas consumer market and bringing back optimized products to the Chinese market.

Pu added that while canned seafood is very popular globally, Chinese are still not used to consuming such products, particularly tuna.

"Through the purchase of the European brand, we look to bring the product and brand home to Chinese consumers. Evoking a change in dining habits will take time, but it is possible," said Pu.

He used raw salmon as an example, noting that more than a decade ago, very few Chinese consumed the product. However, following consistent advertisements of salmon's high nutritional value, many Chinese today can be found eating this fish.

"We believe that nutritious canned tuna can be as popular as salmon in the future," said Yang Huimin, president of Longmen Food Co Ltd, another brand under Shanghai Fisheries.

Together with its sister brand Shuijinyang, which stocks more premium products, Longmen has established major channels for Chinese consumers to buy imported seafood products from Shanghai Fisheries.

Pu said that the two brands launched a joint e-commerce flagship store on Tmall.com in June and has been receiving positive feedback from buyers since.

- International trade corridor tested

- Netizens go crazy for beautiful young doctor who helps woman give birth in shopping mall

- Organ harvesting rumors slammed

- Beijing to try out 5G in key areas by 2020

- Nation's next generation of missiles to be highly flexible

- Li urges top advisers to rely on broad vision

- Malaysian authorities say ship carrying diesel hijacked

- Army commander: THAAD would 'easily affect' China-US ties

- Twin panda cubs confirmed born in Vienna zoo

- Four killed in boat collision in Greece

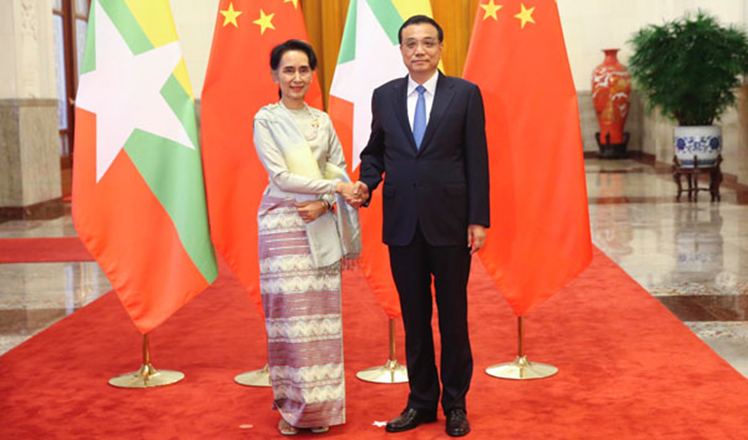

- Premier Li to receive Aung San Suu Kyi

- S Korean president names 3 new ministers for partial reshuffle

Top 10 cities with highest GDP in H1

Top 10 cities with highest GDP in H1

Chinese teenagers take gold, silver on 10m platform

Chinese teenagers take gold, silver on 10m platform

US granted re-run to send China out of relay race

US granted re-run to send China out of relay race

China inches toward gold after beating Netherlands

China inches toward gold after beating Netherlands

Premier Li welcomes Aung San Suu Kyi

Premier Li welcomes Aung San Suu Kyi

Zhao wins China's first gold medal in men's taekwondo

Zhao wins China's first gold medal in men's taekwondo

World's top 10 innovative economies

World's top 10 innovative economies

Dancing, food and religion, all in a Xinjiang wedding

Dancing, food and religion, all in a Xinjiang wedding

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|