Rural consumer confidence beats big city levels

Updated: 2012-08-02 07:59

By Wei Tian (China Daily)

|

||||||||

Consumer confidence in China's biggest cities rallied in the second quarter of the year, reaching its highest level in nearly three years, spurred by improving job prospects, better personal finances and a greater willingness to spend, according to a survey.

But it was rural consumers who remained the most optimistic, said Nielsen, the global information and measurement company which carried out the analysis.

The results for China were contained in a world survey that polled more than 28,000 consumers in 56 countries. The findings showed that China's consumer confidence was significantly ahead of global sentiment.

Consumer confidence levels above and below a baseline of 100 indicate degrees of optimism and pessimism.

The Chinese findings showed the consumer confidence index for first-tier cities was the only regional sub-index to rise quarterly - but the bounce to 107 from 101 in the first three months of the year still left China's biggest cities lagging behind their rural cousins, which remained the most optimistic with a confidence index of 113, 8 index points above the national average of 105.

Job optimism

Year-on-year, rural confidence increased 3 index points.

Chinese consumer confidence decreased 5 index points during the quarter, yet was still a clear 14 points above the global average of 91.

"After a few consecutive quarters of increases in consumer confidence, it is reasonable to see some pullback," said Yan Xuan, president of Nielsen Greater China.

"Confidence cannot increase indefinitely, especially in light of the current global economy and the ongoing European debt woes as well as their impact on China's export growth.

"But over time, the Chinese government's efforts to transform China into a consumption-led economy will pay off for the country."

Consumers in rural Chinese areas indicated the greatest confidence about their employment prospects (92 percent) followed by consumers in first-tier cites, where 52 percent of consumers were bullish about their job prospects in the next six months, 7 points up from the previous quarter.

In contrast, consumers in second-tier cities were the least optimistic and exhibited below average confidence about their employment prospects.

"Affected by the global economic downturn, the weak manufacturing and export sectors led to poor job prospects for consumers in lower-tier cities, especially in second-tier cities," Yan said.

"In first-tier cities, job growth in the service industry boosted consumer confidence in their job expectations."

Consumers in first-tier cities remained the most optimistic about their personal income, showing a 7 point increase to 71 percent compared with 64 percent last quarter, followed by consumers in rural areas, who posted 70 percent.

Slower economic and job growth led to lower income expectations in lower tiers, said Yan, who explained that the rise in first-tier income expectations was probably the result of better employment prospects, combined with a lower consumer price index.

Consumers in first-tier cities were the most willing to spend (48 percent) compared with 40 percent a year ago, followed by consumers in third- and fourth-tier cities (37 percent).

Lian Ping, chief economist with Bank of Communications, said the warming of the property and car markets helped restore consumption increase in July.

"As prices continue to retreat in the third quarter, together with more incentives introduced by local authorities and the gradual advancement of income distribution reforms, social consumption growth will pick up in the second half," Lian said.

According to the survey, consumers between 30 to 39 years old were more confident in the economy than younger consumers for the first time since the fourth quarter of 2011.

Digital wish lists

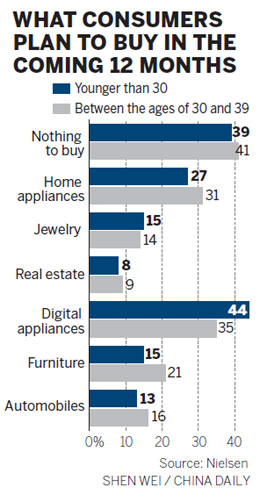

Digital and home appliances, and furniture were at the top of consumers' shopping lists, for both the younger demographic and the 30-39 age group.

Forty-four percent of Chinese consumers younger than 30 are planning to buy digital appliances, while 35 percent between 30 and 39 had them on their lists.

Dale Preston, senior vice-president of Nielsen Greater China, added that total sales of fast-moving consumer goods in the second quarter increased by 17 percent year-on-year.

"We see sales in categories like chocolate and confectionaries both increasing at above 23 percent year-on-year - showing that despite the decline in confidence, consumers in China still like to indulge themselves.

"Lower-tier cities also continue to be an important area of interest. Even though the pace of sales has slowed in lower tiers and rural areas, they still represent significant current business. Continued investment is essential for long-term success."

weitian@chinadaily.com.cn

(China Daily 08/02/2012 page13)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|