ZTE sets sights on leading global role

Updated: 2012-08-30 08:05

By Shen Jingting (China Daily)

|

||||||||

|

Telecom technologies on display at an international exhibition in Beijing. ZTE Corp is the world's fifth-largest telecom equipment supplier by sales. Wu Changqing / for China Daily |

Iconic chairman reveals secrets of company's success amid downturns in world telecom sector

ZTE Corp has the potential to become one of the world's top three telecom equipment makers by surpassing Nokia Siemens Networks and Alcatel-Lucent SA in terms of sales but it still needs time, according to Hou Weigui, its chairman.

Hou, 70, who founded Zhongxing Semiconductor Co Ltd, the predecessor of ZTE, in China's southern coastal city of Shenzhen in 1985, has seen his company grow from being virtually unknown to becoming a top league player in the world's telecom industry.

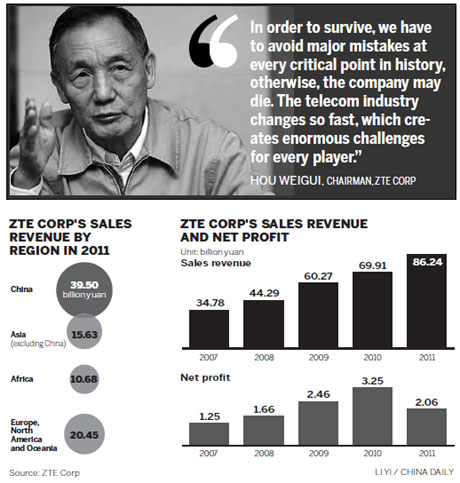

Despite slow spending in telecom infrastructure by worldwide telecom carriers, ZTE's revenue achieved year-on-year growth of 23.4 percent - the highest among all industry rivals - to 86.2 billion yuan ($13.58 billion) in 2011.

The company is the world's fifth-largest telecom equipment supplier by sales, behind Telefon AB LM Ericsson, Huawei Technologies Co Ltd, Alcatel-Lucent and Nokia Siemens Networks.

"ZTE presented a strong development momentum," said Hou, in an interview with China Daily. Although it is good to see ZTE expanding rapidly, he said the company would be cautious about sacrificing too much short-term interest for market share.

"ZTE's core target is to maintain a healthy growth, which demands that we balance the company's cash flow, profit and scale ... Slowly but steadily, we will overtake them (Alcatel-Lucent and Nokia Siemens Networks)," Hou said.

Nokia Siemens Networks realized net sales of 14.04 billion euros ($17.57 billion) in 2011, while Alcatel-Lucent's sales were down 2.1 percent to 15.3 billion euros last year.

Reasons behind success

Hou is regarded as an iconic business figure in China. He shared fame with other pioneer Chinese entrepreneurs who emerged after the launch of the country's reform and opening-up. They include Liu Chuanzhi, the founder of Lenovo Group, and Ren Zhengfei, president of ZTE's cross-town rival - Huawei Technologies Co Ltd.

Compared with Ren, who is said to be "tough" and "mysterious" and who turns down all media interview requests, ZTE's Hou is mild, modest and quiet and occasionally communicates with the media. Whenever he attends the World Mobile Congress or pays a visit overseas, Hou always adopts a Zen-like approach when dealing with people.

He usually flies economy class and leads a simple life. Some describe him as a workaholic. He spends one-third of his time every year traveling to different countries in the hope of learning from customers.

Analysts said Huawei and ZTE, both Shenzhen-based, demonstrate different styles of doing business: The former is aggressive; the latter is much milder. It can be said they reflect their founders' personalities.

"Both Huawei and ZTE were founded in the 1980s but were tiny through to the late 1990s. In the interim, foreign vendors were the incumbents," C.W. Cheung, Asia-Pacific consulting director of technology at the research firm Ovum Plc, wrote in an e-mail to China Daily.

"Over the last 10 years, though, Chinese vendors have become dominant in many sectors domestically and, for Huawei, ZTE and others, increasingly international as well," he added.

When Hou recalls the past, he concludes that it was because ZTE did the right things at the right time so that the company achieved rapid development. "In order to survive, we have to avoid major mistakes at every critical point in history, otherwise, the company may die," he said. "The telecom industry changes so fast, which creates enormous challenges for every player."

First, the company should have good judgment in terms of strategy. It has to avoid putting resources in short-lived technologies. In addition, the company should not conduct mergers and acquisitions blindly, which wastes money, he added. "Then the company should be sensitive to market trends and respond to them."

Rising from downturns

ZTE, which listed on the Shenzhen Stock Exchange in 1997 and in Hong Kong in 2004, increased its total sales from 9.3 billion yuan in 2001 to 86.3 billion yuan in 2011.

During the same period, the world's telecom industry suffered two major downturns. One occurred around 2002, when major telecom carriers across the world had just finished second-generation network development and had not yet started the large-scale purchase of third-generation infrastructure.

Rivals such as Ericsson and Huawei posted negative revenue growth in 2002. ZTE, however, escaped the fallout. It realized a modest earnings increase during the period because products using the CDMA mobile phone standard bore fruit and won significant contracts from the domestic market.

The other industry downturn was after the 2008 global financial crisis. Because many telecom carriers faced financial pressure and tightened their budgets, telecom equipment makers experienced another tough period.

Europe and the United States were the home markets and biggest revenue sources for many foreign rivals such as Ericsson and Alcatel-Lucent. After 2008, the developed countries' smaller markets prompted some companies to cut jobs and caused losses.

In contrast, ZTE rose quickly by benefiting from the construction of China's vast 3G networks since 2008. It grabbed the biggest market share - 36 percent - of China's 3G network infrastructure market in 2009, Hou said.

Obviously, the financial crisis meant more opportunities for ZTE than risks, analysts point out. "The prolonged global financial instability and difficulties over the last several years helped differentiate the low price, high performance value propositions of the Chinese vendors," Cheung said.

"The financial crisis challenged different companies in different ways," Hou said. Because of high costs, the products from foreign telecom equipment vendors were less attractive. Fewer sales resulted in slower technology upgrades, which further hurt their market positions. "As foreign rivals were losing market share, it created room for ZTE to catch up," Hou added.

Overseas expansion

ZTE has operated in overseas markets for about 17 years. The company started to export a few of its products in 1995. From 1998, it began to acquire contract projects and was able to ship products in large quantities to overseas markets.

Shi Lirong, chief executive officer of ZTE, said the company adopted a new marketing strategy in 2006 by strengthening cooperation with multinational telecom operators. "We cooperate with them in both emerging markets and mature, developed countries," Shi said.

There are hundreds of telecom operators in the world but only 20 percent of them, about 30 operators, are in big demand. "Whoever takes the biggest share of contracts from those operators is likely to become the biggest winner," Shi said.

In addition, ZTE focuses on expansion in some big countries and regions, such as the European and North American markets, Japan and the BRIC countries (Brazil, Russia, India and China). Hou said big countries have big populations and economies, which provides opportunities for enormous investment in network infrastructure.

"Overseas markets may eventually account for as much as 80 percent of ZTE Corp's total sales," Hou said. ZTE's overseas revenue reached 46.76 billion yuan, or 54.2 percent of its total revenue, in 2011, from 4 percent 10 years ago. The figure will continue to grow, but Hou did not predict when ZTE will realize the 80 percent goal.

Matt Walker, principal analyst at Ovum, said ZTE has proven itself to be committed to working with carriers in emerging markets. "Strong support by vendors such as ZTE is one reason for the mobile boom in emerging markets that has been apparent over the last five years or so," he said.

However, ZTE's overseas expansion faces severe challenges in the United States and India due to political and security concerns. ZTE was prevented from selling network infrastructure to major US operators and limited to signing contracts with a few small US carriers. The Indian authorities also imposed harsh restrictions on ZTE's business with local partners.

Hou did not conceal his disappointment at ZTE's setbacks in the United States. "It's useless making further efforts (to persuade the US government to trust ZTE). The problem cannot be solved," Hou said.

Redefining ZTE

This year could herald a harsh winter for telecom companies, analysts say. Telecom carriers slowed investment and became picky. Competition intensified and most telecom equipment makers said that they could not afford to further cut product prices.

In a recent filing to the Shenzhen Stock Exchange, ZTE said its first-half net profit fell 68 percent to 245 million yuan because of lower investment gains, foreign exchange losses and domestic operator networks postponing their tenders.

"ZTE has had to evolve with the times," said Walker at Ovum. "ZTE seems to be at a crossroads now, where it can and should stake out its own, independent vision and clarify its unique role in the industry."

He Shiyou, senior vice-president of ZTE, said the company would transform itself from a telecom equipment maker into a "communications integrated-solution provider". The company already owns a complete product line and has a well-functioning global marketing network, he said.

New business areas, including mobile devices, cloud computing and telecom services, are likely to become major drivers for ZTE in the near future, Hou said.

The company plans to double its smartphone shipments to more than 30 million this year and become one of the world's top three cellphone vendors by 2015. ZTE also aims for sales to government and businesses to hit more than $6 billion by 2015.

Neil Mawston, an analyst with Strategy Analytics, said ZTE is growing rapidly in entry-level and mid-range smartphones but Apple and Samsung dominate the premium segment. "ZTE's biggest long-term challenge will be to develop a connected portfolio of smartphones, tablets, smart TVs and cloud services so it can compete better with rivals such as Apple's iPhone, iPad and iTunes," he said.

shenjingting@chinadaily.com.cn

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|