Xi-Obama Summit: investors watch for signs

Updated: 2013-06-07 13:09

By Michael Barris (China Daily)

|

||||||||

'Super cities'

Chinese investment growth has been especially strong in the five "super cities" of Hong Kong, New York, London, Singapore and Sydney, according to Jones Lang LaSalle. The first three cities have seen investments of almost $2 billion to $3 billion between 2003 and 2012, the firm said. David Green-Morgan, Jones Lang LaSalle's global capital-markets research director, told financial-news cable channel CNBC that Chinese individual investors are primarily interested in the industrial and hotel spaces in those cities, but a lot of demand is also coming from companies, he said.

"The Chinese government has a policy of globalizing Chinese companies, so we see a lot of demand from corporate who like to own their own buildings when they go overseas," Green-Morgan said. "They may rent some office space for a year or two and then look around for a building they can buy themselves."

Another reason for increased Chinese interest in commercial property is because "institutional investors and high net-worth individuals are able to transfer money out of China more easily now," Green-Morgan said. "That is a big hurdle taken out of the way".

Many Chinese property developers have found in the Chinese mainland market closed to them as the government takes steps to cool the domestic property market amid skyrocketing housing prices. They are looking abroad to diversify and meet demand from Chinese investors.

On the books is a plan by Chinese development firm ABP Chinese (Holding) to build a Chinese and Asian financial and business center in eastern London's 130-year-old Royal Albert Dock area. ABP received approval on May 31 for the 1 billion pound ($1.51 billion) project, claimed to be the largest commercial real-estate undertaking involving Chinese investment in Britain.

In Australia, Shanghai-based Greenland Group in March acquired a residential and hotel building in downtown Sydney from Canadian firm Brookfield Asset Management for A$107.5 million ($111.4 million).

In Canada, where the housing market has seen frenzied Chinese buying, the commercial sector is poised for a wave of new investment amid low interest rates, the continued availability of equity and debt, and healthy supply-demand fundamentals, according to CIBC World Markets Inc.

In the US, the wave of Chinese real-estate spending is helping to revive a commercial real estate market that was damaged by the recession and slow economic recovery.

Bloomberg News, citing sources with direct knowledge of the situation, reported on May 27 that China is studying the possibility of investing a portion of its $3.4 trillion in foreign-exchange reserves in US real estate. The State Administration of Foreign Exchange began the study after seeing signs of a recovery in the US property market, the sources said. China may acquire properties, invest in real estate funds or buy stakes in property companies, the sources said.

Investing in US real estate would tie in with China's move to establish an operation in New York to make alternative investments in the US, an effort by the country's foreign-exchange reserves manager to diversify away from US government debt, the Wall Street Journal reported, citing people it did not identify.

"In the long run it should be a good opportunity, as the US property market is gradually recovering," Frank Chen, head of China research at CBRE Group, was quoted as saying. "It will help diversity the foreign reserves' investment portfolio. Properties such as office buildings have stable yields, which match its investment strategies."

Two US deals in particular earlier this year appeared to represent a step in the progression of Chinese investment in the US since the global financial crisis.

Vanke joint venture

In mid-February, China's biggest property developer, Vanke Co, formed a joint venture with Tishman Speyer of the US to develop two high-rise condominium towers in San Francisco that are likely to draw wealthy Chinese buyers. It is Vanke's first foray into the US market, the companies said.

The project, to be managed by Tishman Speyer, will cost about $620 million, with Vanke contributing $175 million and Tishman Speyer $75 million, Reuters reported, citing a source familiar with the deal. Debt financing will cover the rest of the cost. Vanke will have a 70 percent stake in the joint venture and Tishman 30 percent, the source said.

Just two weeks later, Malaysian gambling company Genting Group agreed to pay $350 million to acquire from Boyd Gaming Corp 87 acres in Las Vegas. Genting plans to start construction on a multibillion-dollar casino complex called Resorts World there next year. It would be the first major casino initiated in the wake of the economic downturn of 2008.

The two deals are worth a combined $1 billion - a fraction of the $102 billion in investment abroad from companies in the Asia-Pacific region in 2012, according to Thomson Reuters. But they signal a strategic shift. Instead of pursuing natural resources, the driving force behind many of Asia's biggest recent foreign acquisitions, these companies are investing in the US to cater to Chinese consumers abroad.

Jeremy Aguero, a Las Vegas economist and consultant, called the move by the Malaysian company "a game changer" in that it reversed a recent trend by Las Vegas casino companies to expand in Asia, where casino markets are generally seen as a much greater growth opportunity than in the US.

"I certainly didn't expect something like this would happen quite this early," he told the Wall Street Journal. "People were expecting a big new casino in Las Vegas was still three to five years away."

Until the Genting and Vanke deals, there was little evidence that large Asian companies were following the money trail to the United States.

"You have Chinese money sitting in US houses and Chinese money sitting in US banks. If you're smart, you start setting up places for Chinese people to stay and things for them to buy," said Derek Scissors, an economist who tracks Chinese foreign investment for the Heritage Foundation, a research organization in Washington.

Analysts said that for Vanke, venturing into the US makes sense now because Beijing is clamping down on property speculation at home. New restrictions announced March 1 may speed the flow of Chinese property investment abroad.

"Vanke will go anywhere" that mainland Chinese want to go, said Du Jinsong, a property analyst at Credit Suisse in Hong Kong. "Their target customer is not overseas Chinese. Their target customer is mainland Chinese who want to migrate to overseas, or have a home outside the country."

Chinese buyers also are investing in Seattle-area real estate in growing numbers. The Seattle Times reported that Chinese investors are "accelerating the real-estate market's recovery, sometimes edging out other buyers with all-cash offers, and deepening ties between Seattle and China".

Rainstorms cause severe flooding and landslides

Rainstorms cause severe flooding and landslides

Teenage girls were best friends

Teenage girls were best friends

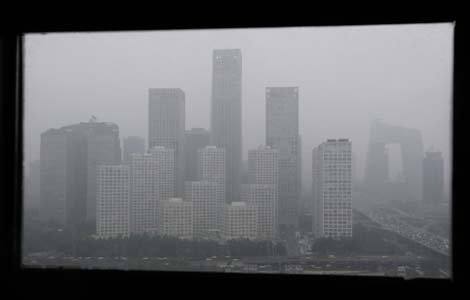

Coal burning in China's north can shorten lives

Coal burning in China's north can shorten lives

Some solar companies see brighter first half

Some solar companies see brighter first half

Thousands flock to Texas Capitol over abortion

Thousands flock to Texas Capitol over abortion

China's youngest city glistens under palm trees

China's youngest city glistens under palm trees

Xinjiang tourism recovering

Xinjiang tourism recovering

Quebec disaster death toll jumps to 13

Quebec disaster death toll jumps to 13

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Rainstorms cause severe flooding and landslides

Honesty is a challenge for CPC

Teenage girls were best friends

Coal burning in China's north can shorten lives

Some solar companies see brighter first half

Peak Sport shares rebound after Monday plunge

China's consumer confidence drops in June

Li reassures sugarcane farmers

US Weekly

|

|