Xi-Obama Summit: investors watch for signs

Updated: 2013-06-07 13:09

By Michael Barris (China Daily)

|

||||||||

New York's allure

But for Chinese investors, New York holds special allure. Cross-national exchanges in a multitude of areas, from fashion to luxury lifestyle to entertainment to cuisine have paved the way for new investment in the Big Apple. In real estate, the soaring towers built by developers such as Zhang Xin's Soho China Ltd, the biggest developer in Beijing's central business district, would have a place amid Manhattan's canyons of steel and glass.

The Zhang-led group's purchase, together with Brazil's Safra family, of the interest in the 50-story GM building is seen as signifying the revitalization of the high-end New York property market. The 2 million square-foot tower built in 1968 sits in a prime midtown Manhattan location on Fifth Avenue, home to one of the world's most prominent shopping districts, and across from Central Park, making its office rents among the city's highest.

Michael Knott, a real estate analyst with California-based Green Street Advisers, said that the sale of the GM building stake to the Zhang group by a Goldman Sachs Group Inc real-estate fund and Meraas Capital on behalf of Middle Eastern investors "represents a big but fair price for a trophy US office building, the trophy among trophies". More broadly, the reported sale price "shows that the highest quality US commercial real estate is faring well amid low interest rates", Knott said.

Zhang, ranked by Forbes as the world's seventh-richest self-made woman, invested in the GM building with her own personal wealth, estimated at $3.6 billion, not with Soho China's funds, Reuters reported, citing sources.

Darcy Stacom, who co-handled the stake sale for CBRE Group Inc, described the deal as "a return to the billion-dollar plus level for an individual investment transaction". She said it underscores "both the GM building's universal appeal as one of the world's most important commercial assets and New York City's undiminished value, as the premier location for trophy investment properties."

Foreign projects are still a fraction of the overall portfolio of Chinese developers, who had $226 billion in residential and commercial sales in the first quarter, up 61 percent from the same period in 2012.

Nicole Wong, a property analyst for brokerage and investment group CLSA Asia-Pacific Markets in Hong Kong, told Forbes that although foreign projects amount to side interests for Chinese developers, those who do venture overseas could prove more resilient in a domestic downturn.

"The problem in China is that every [asset] moves together ... By having offshore activities, particularly for larger companies, they can find some countercyclical business that helps offset their Chinese businesses," Wong was quoted as saying.

Overseas projects offer a hedge for both developers and their wealthy customers, who typically own multiple properties at home and see offshore real estate as a track to a foreign residency.

Credit Suisse's Du told Forbes that developers are starting to follow their customers into offshore markets. "Most developers that I talk to definitely won't rule out overseas ventures," he said. "But they're going cautiously. This is only the start of the trend."

Based on Chinese investors' current buying spree, the meeting of that trend and the Xi-Obama summit could have profound implications for the commercial property market - not just in the US, but around the world.

Contact the writer at michaelbarris@chinadailyusa.com

(China Daily USA 06/07/2013 page22)

Rainstorms cause severe flooding and landslides

Rainstorms cause severe flooding and landslides

Teenage girls were best friends

Teenage girls were best friends

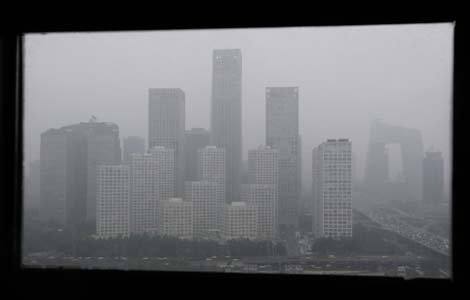

Coal burning in China's north can shorten lives

Coal burning in China's north can shorten lives

Some solar companies see brighter first half

Some solar companies see brighter first half

Thousands flock to Texas Capitol over abortion

Thousands flock to Texas Capitol over abortion

China's youngest city glistens under palm trees

China's youngest city glistens under palm trees

Xinjiang tourism recovering

Xinjiang tourism recovering

Quebec disaster death toll jumps to 13

Quebec disaster death toll jumps to 13

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Rainstorms cause severe flooding and landslides

Honesty is a challenge for CPC

Teenage girls were best friends

Coal burning in China's north can shorten lives

Some solar companies see brighter first half

Peak Sport shares rebound after Monday plunge

China's consumer confidence drops in June

Li reassures sugarcane farmers

US Weekly

|

|