Japan shifts more investment to ASEAN in strategic rebalancing

Updated: 2014-09-01 06:44

By Cornelia Zou in Hong Kong(China Daily USA)

|

||||||||

Don't be surprised if the next time you buy a Japanese product, you discover that instead of "made in China", the label says "made in Thailand" or "made in Indonesia".

Japan is looking to the Association of Southeast Asian Nations as an investment destination for manufacturing due, in large part, to the rising cost of labor in China.

"China is still a big country with huge potential for the Japanese," says Yasuhide Fujii, managing partner at consultancy KPMG's Myanmar office.

|

A Toyota Motor production line in Jakarta, Indonesia. Many Japanese companies are opening or expanding production bases in Southeast Asia because of the region's rising number of consumers as well as the cheaper cost of manufacturing. AFP |

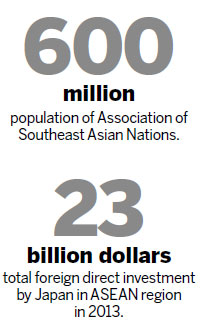

But ASEAN's population of around 600 million means that Japanese investors are looking at the combined market in a similar way to how they view China, Fujii says.

According to ASEAN statistics on foreign direct investment, Japan invested about $23 billion in the region in 2013, accounting for 19 percent of total FDI among the 10 member economies. Japan was the second-largest source of FDI after the European Union, which invested about $27 billion. In comparison, Japan only invested $9 billion in China in 2013, a 32.5 percent drop compared with 2012.

"The cost of labor in China is getting higher," says Fujii, adding that in order to expand manufacturing facilities, Japanese firms are "looking at the lower cost areas like Vietnam, Cambodia and Myanmar".

Stephen Patrick, vice-president of equity research company Ji Asia, says that rising labor costs in China have been a talking point for the past few years.

"Basically, the savings China had for the differentiation of labor costs versus some of the ASEAN countries have closed," he says.

Japanese companies are not the only ones dealing with higher labor costs in China. Chinese companies are spending more on factory automation or robots as a long-term solution to both labor market instability and rising costs.

Patrick says that territorial issues are also a factor to be considered in this investment shift. In September 2012, demonstrations in China followed Japan's attempt to take control of China's Diaoyu Islands.

"The protests that happened in China were more of a catalyst for speeding up this process that was already in place," says Patrick. "But there were protests and damage to Japanese retail and production facilities ... that probably encourage Japanese companies to hedge themselves a bit more."

ASEAN may be attracting more total investment from Japan, but in terms of individual countries, China is still Japan's number one recipient of outward FDI in Asia, so the shift, although significant, is a strategic rebalancing rather than a withdrawal.

"The Japanese are not going to pull out of China," Patrick says. "Larger increases in production facilities will be made in ASEAN countries as opposed to enhancing the same in China."

The geographical proximity of ASEAN countries and significant supply chain infrastructure in countries like Thailand and Vietnam make ASEAN countries attractive choices for Japanese companies.

"The whole supply chain is much easier to manage when the production facility is closer in a geographic area," says Patrick.

Another aspect of the ongoing investment shift is that Japanese companies are hoping to increase their market share in ASEAN countries, which in general have rising disposable incomes and young population.

"The ASEAN market is a priority for Japanese investors not only because of its population - India also has a large population - but also because Japanese products are still preferred in these countries," says Fujii from KPMG.

Many Japanese companies involved in the automobile, electronics and consumer goods markets already have a strong market share in ASEAN, which they want to keep.

In August, leading Japanese consumer products manufacturer Kao Corporation announced that it plans to boost its presence and manufacturing facilities in ASEAN.

Kozo Saito, an executive officer at Kao, says the company will invest about $400 million in Thailand and Indonesia to increase its manufacturing capacity and launch more products, as these countries are management centers within ASEAN.

The move comes in the run-up to the launch of the ASEAN Economic Community next year, which is expected to stimulate regional consumer demand. Kao has three production bases in the region - in Thailand, Indonesia and Vietnam.

In June, Kao completed its second production plant in Indonesia. The new plant, located in Karawang International Industrial City in Java, Indonesia's most developed island, was built to meet the growing needs of the Indonesian market and will produce the new detergents Kao launched in the country in July.

Michitaka Sawada, Kao president and CEO, said in a statement: "Indonesia is a critical market for the success of Kao's global growth strategy. The new plant will play an important role as a production base for the Indonesian market and other Asian markets in the future."

Japan invested over $10 billion in Thailand in 2013, twice what it invested there in 2012. It also invested $4 billion in Indonesia, $3 billion in Vietnam, and $1.2 billion in the Philippines. Japanese investment increased in all ASEAN countries in 2013, except in Malaysia, where Japan's FDI contracted $43 million year-on-year.

Japan is the largest source of FDI in Thailand, where companies focus mainly on the automobile and consumer goods sectors in the country. Foreign investors involved in the manufacturing sector may not receive as many incentives from the Thai government as before.

"Nothing has changed at the moment, but the Thai government is showing some intention to change the policy on foreign investment incentives," says Fujii. "They want to shift more investment to high-end industries instead of the low-end manufacturing industry."

Myanmar is still a FDI greenfield. However, investors see great potential in its natural resources. In this regard, Japanese firms are a step ahead of companies from the United States and European Union.

"The Japanese government is strongly supportive of the Myanmar government, that's why we have a bit more investment here in Myanmar," says Fujii. "Japan is supporting Myanmar financially to develop its infrastructure so that foreign companies can make their investments in Myanmar."

ASEAN FDI in Japan is rather limited. Last year, only four ASEAN countries invested in Japan. Singapore's investments in Japan in 2013 totaled $325 million, Malaysia $75 million, and the Philippines and Thailand $7 million and $3 million, respectively.

Patrick says that ASEAN investors are more likely to focus on niche areas and new technology when it comes to investing in Japan. The industry in Japan receiving the most FDI last year was electric machinery, which received $1.5 billion.

"(ASEAN investment in Japan) may change to a certain degree, with Abenomics (referring to Prime Minister Shinzo Abe's economic policies, including fiscal stimulus) and changes in the current administration," says Patrick. "But the general trend in Japan is to avoid a complete hollowing out of the technology advantages they have."

(China Daily USA 09/01/2014 page14)

Peace Mission - 2014 military drill ends in China's Inner Mongolia

Peace Mission - 2014 military drill ends in China's Inner Mongolia

First steps on a journey of discovery

First steps on a journey of discovery

Garbage dump turns water into poison

Garbage dump turns water into poison

Vintage cars exhibition opens in Jinan

Vintage cars exhibition opens in Jinan

Discussion on Chinese FDI

Discussion on Chinese FDI

Boeing, Xiamen Airlines celebrate 787 Dreamliner delivery

Boeing, Xiamen Airlines celebrate 787 Dreamliner delivery

US photographer captures amazing starry night

US photographer captures amazing starry night

More earthquake relief rolls in

More earthquake relief rolls in

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese American to run NYC public schools' fund

US launches fresh air strikes on IS rebels

NPC decision a landmark in HK democratic development

Chui Sai On elected Macao chief executive-designate

Exhibition on China-US WWII collaboration unveiled

Google building delivery drones

US, China plan followup to Sunnylands summit

US urged to stop recon

US Weekly

|

|