Downsizing at the 'World's Factory'

Updated: 2016-08-19 10:06

By Paul Welitzkin in New York(China Daily USA)

|

||||||||

The US presidential election has put a renewed focus on the loss of American factory jobs to manufacturers abroad, with both candidates pointing to China as a main villain. But China itself is losing jobs, reports Paul Welitzkin in New York.

For Donald Trump, China has been a focus of his criticism since the Republican primaries and now as the party's presidential nominee, saying repeatedly: "They're stealing our jobs; they're beating us in everything; they're winning, we're losing."

And Democratic challenger Hilary Clinton has said that the US has to "stand up" to China and make it stop unfair trade practices that hurt American businesses and kill US jobs.

Since the 1990s, China has been the symbol of a job-creating juggernaut - the "world's factory". Manufacturers from the US and other Western countries poured into the country to take advantage of low wages and other costs, leaving behind millions of jobless.

Now, it's a changing story. China is posting its weakest growth in 25 years. Manufacturing advantages China once enjoyed have dwindled. The push to revamp China's economy, the reform of State-owned enterprises (SOEs) and competition from other low-cost nations have combined to drive up unemployment in parts of the mainland.

According to Quanton Data, which tracks global job postings by industry, open manufacturing positions in China have been declining consistently since 2012, down nearly six per cent in that time. Historically low wages have risen as China seeks to grow its middle class, making nearby neighboring countries like Bangladesh and Vietnam more attractive labor markets.

Other manufacturing costs such as transporting goods to the US have increased to the point where some US manufacturers are finding it advantageous to "reshore" operations back to America.

"These are the things that happen when economies reshape themselves," said Thomas Rawksi, a professor of economics at the University of Pittsburgh, who has written extensively on the economy of China.

Cheap labor has been a key component of China's economic success in the last 25 years. After the introduction of reforms in the 1980s that opened up China to foreign businesses, manufacturing took off as Chinese workers were plentiful and their

But that cost advantage is shrinking. Monthly pay for China's factory workers now averages $424, 29 percent more than just three years ago, the Japan External Trade Organization estimated, according to a recent New York Times article. Factory workers in Vietnam earn less than half the salary of a Chinese worker, while those in Bangladesh get paid less than a quarter as much.

US companies were among the first to open up shop in the mainland and employ thousands to make products that used to be manufactured in America. The Economic Policy Institute said the US lost about 3.2 million jobs to China between 2001 and 2013, with three-fourths of those jobs in manufacturing.

That off-shoring wave is beginning to change, according to the Reshoring Initiative, a nonprofit trade organization dedicated to revitalizing manufacturing in the US.

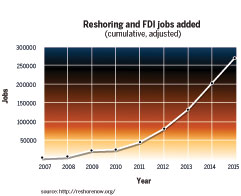

The organization's 2015 Reshoring Report contains data on US reshoring and Foreign Direct Investment (FDI) by companies that have returned or added new US production from offshore. The report includes cumulative data from 2007 through 2015, as well as detailed data for 2015.

More jobs

The combined reshoring and FDI trends in 2015 resulted in the addition of 67,000 jobs in the US, bringing the total number of manufacturing jobs from offshore to more than 249,000 since a manufacturing employment low in February 2010.

Harry Moser, president of the Reshoring Initiative, told the New Yorker earlier this year that since 2007 the annual increase in the number of companies' offshoring has dropped from 6 percent to 2.5 percent. Moser said that for the past couple of years, for every new job offered by US companies overseas, an equal number of positions have been reshored.

Rising costs have also forced even Chinese-based manufacturers to reassess their operations, according to Rawksi, who regularly visited China throughout 1970s and 1980s. He said some Chinese manufacturers are considering their options to stay competitive.

"Some have considered moving plants offshore and to western China. The wages are lower in Vietnam and Bangladesh," he said.

Western China is becoming attractive for companies located in coastal areas because it enables manufacturers to address supply-chain concerns. "That is why some opt for western China because they can still get critical components in 24-36 hours," Rawski said. "It's what is holding many firms in place."

Structural changes in China's economy are also driving employment shifts in the country, according to Li Wei, a professor of economics at the Cheung Kong Graduate School of Business (CKGSB) in China. There is a downturn in the steel and cement industries in part because the "housing market in China won't grow as rapidly as it has in the past," Wei said.

China has also been on a mission to reform many of its SOEs. In July, President Xi Jinping asked for efforts to deepen the reform of State-owned enterprises. He said SOEs are an important force for national development and guarding people's interests, but also called for ways to enhance their vitality, competitiveness and resistance to risk.

The government has identified SOE reform as an essential step in the structural transformation of China's economy. Over the last three decades, SOEs have underpinned China's emergence as a global manufacturing powerhouse and also dominate key strategic sectors.

However, the traditional single-sided markets are now being disrupted by new technology and private companies, which have underlined the weaknesses of SOEs, such as inefficiency and high operational costs.

China's steel and coal-mining sectors are prime candidates for this reform. In February, the Chinese government said it was planning to shed 1.8 million coal and steel jobs to reduce excess capacity. Some 1.3 million jobs will be lost in the coal sector, and 500,000 in the steel industry. It's important to keep the job losses in perspective since China's labor market totals 600-700 million workers according to Rawksi.

Helping the unemployed

To ease the impact of the cuts, the government has earmarked $15.3 billion over the next two years for unemployment relief, offering training and job placement services.

"Labor productivity is decreasing in China's iron and steel enterprises, and State-owned enterprises are facing even lower labor efficiency than private ones as they are bearing more social burdens," Li Xinchuang, secretary general of the China Iron and Steel Association wrote in an email.

The northeast region of the country - including Heilongjiang, Liaoning, and Jilin provinces which used to be the country's industrial powerhouse - have been suffering amid this transformation.

A restructuring plan announced earlier this year that will combine two major steel companies could be a symbol of SOE reform in China. The planned merger of Wuhan Iron and Steel and Baosteel when completed will create the largest steel producer in China with annual output reaching at least 60 million tons a year.

Wuhan and Baosteel haven't released details on their combination, including potential job losses.

The merger plan was announced as China's steel industry has suffered heavy losses due to overcapacity and sagging global demand. In 2015, more than half of China's steel companies reported losses totaling $9.78 billion, the China Iron and Steel Association estimated.

The steel sector was once a profit engine for China's economy as the infrastructure investment boom bolstered demand for commodities such as steel and cement. As the economy has cooled, the production glut has been exacerbated. China now aims for gross domestic product growth of about 6.5 percent a year, down from the double-digit gains of just a few years ago.

China will not experience an upsurge in layoffs in the drive to revitalize inefficient and overstaffed State-owned enterprises, Xiao Yaqing, head of the State-owned Assets Supervision and Administration Commission, said earlier this year.

"Protecting the interests of SOE employees will be a major task in the next step," said Xiao. The reform will mainly be pushed forward through mergers and acquisitions instead of bankruptcies, he added.

"The government will need to be aggressive in finding jobs for displaced workers," said CKGSB's Wei. "The government can't guarantee that everyone has a job, but it can guarantee that people won't starve."

"The problem is that people who were coal miners and steel workers are not well suited to pick up jobs in the new economy," said Rawksi.

Maintaining stability

Li said the Chinese government is responding to the challenges of this labor shift. "(The) government has been gradually introducing policies to maintain the stability of the society, to create new employment opportunities and to make sure the laid-off workers can steadily transfer between (being) laid-off and re-employment," he said.

Rawski believes the service sector will create many new jobs to replace the ones that are lost. "There will be some structural unemployment where you have people in one sector struggling to find a job while other industries struggle to fill openings with qualified personnel," he said.

"China is advocating and encouraging scientific and technology oriented new enterprises to engage in innovation and entrepreneurship. As iron and steel enterprises are now facing the challenges of excess capacity and significantly decreasing profits, they need to create opportunities to transition toward (the) service industry," said Li.

Contact the writer at paulwelitzkin@chinadailyusa.com

(China Daily USA 08/19/2016 page20)

- Malaysian authorities say ship carrying diesel hijacked

- Army commander: THAAD would 'easily affect' China-US ties

- Twin panda cubs confirmed born in Vienna zoo

- Four killed in boat collision in Greece

- Premier Li to receive Aung San Suu Kyi

- S Korean president names 3 new ministers for partial reshuffle

Top 10 cities with highest GDP in H1

Top 10 cities with highest GDP in H1

Chinese teenagers take gold, silver on 10m platform

Chinese teenagers take gold, silver on 10m platform

US granted re-run to send China out of relay race

US granted re-run to send China out of relay race

China inches toward gold after beating Netherlands

China inches toward gold after beating Netherlands

Premier Li welcomes Aung San Suu Kyi

Premier Li welcomes Aung San Suu Kyi

Zhao wins China's first gold medal in men's taekwondo

Zhao wins China's first gold medal in men's taekwondo

World's top 10 innovative economies

World's top 10 innovative economies

Dancing, food and religion, all in a Xinjiang wedding

Dancing, food and religion, all in a Xinjiang wedding

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|