WTO rules should prevail in dispute

Updated: 2012-06-08 09:29

By He Weiwen (China Daily)

|

||||||||

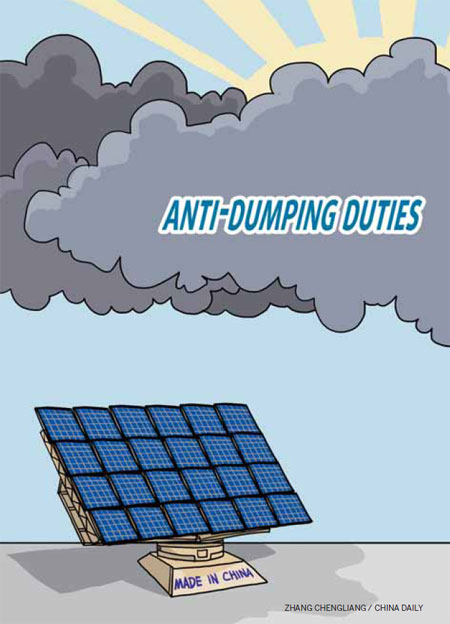

US using domestic legislation to impose unfair sanctions on Chinese solar cells

The US Department of Commerce, in a preliminary ruling on May 17, said it would impose anti-dumping duties (AD) on Chinese crystalline silicon photovoltaic cells (whether or not assembled into modules) ranging from 31.14 percent to 249.96 percent. This follows a US International Trade Commission's preliminary ruling of countervailing duty (CV) of 2.9 percent to 4.73 percent on March 20.

In a firm response, the Chinese government filed with the World Trade Organization on May 25, challenging the US countervailing measures against all 22 Chinese cases including the current one, claiming those measures to be a violation of WTO rules.

WTO rules explicitly prohibit CV on any non-market economy member. China had filed WTO cases of US CV on Chinese off-the-road tires and three other cases a couple of years ago. The WTO panel found on March 11, 2011 that the US CV on the four Chinese items violated WTO rules and should be corrected. However, the US shrugged off the ruling, resulting in a revised 1930 Tariff Act, signed into law on March 13, 2012 by President Barack Obama. The revised act makes CV against China and Vietnam legal, also with a retrospective effect, starting from its first CV on Chinese products (corrugated paper) in October 2006. There have been 22 cases of CV on Chinese products up to now.

The 1930 Tariff Act, as a domestic law, cannot be applied to international trade, which is governed by international law. When a conflict happens between the two, the relevant international law prevails. Hence, all US CV cases on Chinese products have violated WTO rules and must be corrected.

The WTO permits AD against an import product which is sold in the target market at a price below a fair value. However, the relevant GATT clause has also set an explicit definition on dumping:

a) below the same product price for home consumption in the export country, under normal circumstances; or

b) If, in the absence of such a price, below:

the highest comparable export price of the same product to a third country; or:

the actual cost of production in the origin country, plus a reasonable marketing fee and profit.

The US Commerce Department's ruling on the recent Chinese solar cells case is absolutely different. It did not consider the Chinese home price, nor the highest comparable export price to a third country, let alone China's home production cost plus reasonable marketing fee and profit. The only comparison is with Thailand, a country without a complete solar cell production chain and thus no complete data.

How could the US commerce department arrive at a reasonable price from Thailand? It's like a doctor diagnosing a patient: Patient A is running a low fever of 38 C. The doctor, however, does not take that into consideration on the grounds he is not "a market economy". Instead, the doctor tests the body temperature of Patient B (a "market economy") and finds 39.5 C. Thus, the doctor diagnoses Patient A has a "very serious" disease on the basis of 39.5 C. How absurd!

Since the US commerce department asserts that Chinese solar cells are selling in the US at a price below a fair value, lets take a look at its own fact sheet. It shows that exports of Chinese solar cells to the US were 26.88 million units in 2009, with a value of $639.53 million, or $23.80 per unit. In 2011, the volume rose to 932.92 million, up by 247 percent; the value rose to $3,117.37 million, up by 387 percent; with a unit price of $33.42, 40 percent more expensive than two years earlier. Since the department did not find dumping in 2009, how could it find dumping with the price 40 percent higher?

Even taking the USITC's preliminary ruling of 2.9-4.83 percent "subsidy". With that tiny "subsidy", how could the Chinese exporters sell their solar cells in the US at 31.14-249.96 percent "lower than the fair value"?

Since neither CV nor AD of the US ruling is compatible with WTO rules, the only explanation is an abuse of trade remedy, or more explicitly, "quantity protectionism". A trade remedy was resorted simply because of the big increase in solar cells imports from China.

The US' CV and AD cases against Chinese imports have followed a similar pattern in recent years.

Chinese semi-finished steel products accounted for less than 3 percent of US imports in 2002. When the share rose to 8 percent in 2007 and 8.8 percent in 2008, CV and AD cases followed. As a result, China's share fell back to 3.6 percent in 2009.

Chinese auto tires accounted for 25.5 percent of total US imports in 2008. Again, it resulted in CV and AD, and even special safeguards, which led to a sharp fall in China's share to 17.3 percent in 2011, lower than 2006 (18 percent).

China's WTO files are well based on relevant WTO rules. It is believed that both China and the US will enter a WTO dispute settlement mechanism (not bilateral consultation), with little chance of reaching agreement. A WTO panel seems inevitable.

The final finding of the WTO, most likely taking years, could support China, totally or selectively. However, it might be less likely that the US will change its trade remedies against China. When it happens, China will have the legal right to claim an equal compensation from the US, and, if the US fails to do so, to adopt counter measures for the same amount of compensation.

The current CV and AD ruling will do tremendous harm to China's solar cell exports to the US directly, and to Europe indirectly. The US downstream manufacturers, importers, port and warehouse workers, as well as consumers, will also suffer from losing jobs or higher costs. It is really a lose-lose case.

The US CV and AD will undoubtedly impose an adverse impact on China's solar cell exports in the short run, and aggravate domestic over-supply. However, this trend, in turn, will definitely promote structural changes and upgrading in China's infant solar energy industry.

While upgrading export structure, more attention should be paid to outbound investment in various countries, including the US, with a prime goal of supplying the local market, creating jobs there, and enhancing the global competitiveness of the Chinese solar energy industry.

The author is co-director, China-US/EU Study Center, China Association of International Trade. The views do not necessarily reflect those of China Daily.

(China Daily 06/08/2012 page8)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese fleet drives out Japan's boats from Diaoyu

Health new priority for quake zone

Inspired by Guan, more Chinese pick up golf

Russia criticizes US reports on human rights

China, ROK criticize visits to shrine

Sino-US shared interests emphasized

China 'aims to share its dream with world'

Chinese president appoints 5 new ambassadors

US Weekly

|

|