Game changer

Updated: 2012-08-03 08:53

By Meng Jing (China Daily)

|

||||||||

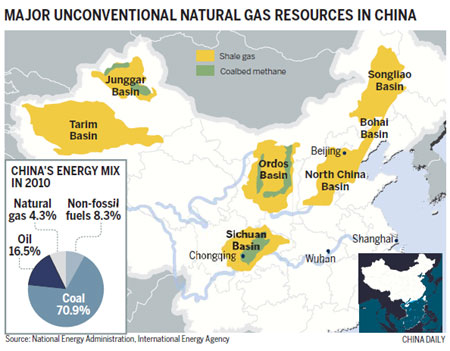

Abundant shale gas reserves augur well for China's clean energy dreams

Like many others, Chen Weidong believes that shale gas will create hundreds of thousands of jobs and solve the problems of energy-intensive industries in China.

Pointing to the amazing shale gas run in the United States that saw the country sitting on huge surplus stocks of natural gas, Chen, the chief energy economist of China National Offshore Oil Corp, says the real gains are the massive reductions in carbon emissions or greenhouse gases that the US has achieved in the last five years.

| ||||

Shale gas is seen as an attractive proposition for nations as it offers abundant clean energy or energy with lower carbon intensity, an important aspect when it comes to fixing national goals. From a consumer perspective, it is worth pursuing as the long-term prospects make it an extremely viable proposition.

But till date, China has not started commercial production of shale gas, unlike the US where it has become a major and plentiful energy source and made the nation more or less self-sufficient in its energy requirements.

There is now a growing urgency in Beijing to further encourage the development of unconventional energy sources as it believes such steps are essential to help reduce carbon emissions and costly gas imports.

Shale gas remains an integral part of the overall energy strategy and the government has outlined a plan that will see China producing 60 to 100 billion cubic meters of natural gas annually by 2020 from shale sources.

To further encourage the key players within the shale gas industry, China has also announced its intentions to open up some shale gas blocks for private companies. That in itself is a major policy change as the 50 trillion yuan ($7.8 trillion, 6.4 trillion euros) industry was till now mostly restricted to State-owned enterprises.

Experts agree that there is no doubt that the industry is set to blossom in China, considering that it has a treasure trove of resources.

"I have great expectations of China's shale gas prospects. We have the resources and the market. Shale gas certainly has the potential to be something big in China. But I am also not overtly optimistic about future development of the sector," says Chen, one of China's foremost experts on unconventional energy .

He says that the industry has been evolving in an indecisive pattern and has still not got the rightful priority it needs. Chen says that such an attitude is surprising, considering that China will face more challenges to meet energy requirements in the wake of rapid urbanization and development.

|

Adi Karev, global head of the oil and gas practice at Deloitte, says the Chinese shale gas industry is an "attractive proposition". Provided to China Daily |

|

From left: Chen Weidong, CNOOC chief energy economist; Li Yuxi, senior researcher at the Ministry of Land and Resources; and Ye Dengsheng, general manager of a downhole service company under China National Petroleum Corp. |

Future in gas

Natural gas is the practical solution to China's long-term energy requirements, as other unconventional sources like wind and solar power have proved to be expensive propositions, Chen says.

Though China has the largest installed capacity in wind turbines and is the largest maker of solar panels in the world, it is not safe for the energy-hungry nation to solely focus on renewable energies, experts say.

Energy demand is expected to jump sharply by 2030, when China becomes the largest economy in the world, experts say. According to the BP Energy Outlook 2030 released in January, China's energy consumption in 2030 will be more than the combined demand of the US and Europe.

During the same period the energy deficit between China's own production and consumption is expected to jump six-fold over that of 2010, according to the report. China already imports more than 55 percent of its oil requirements and 20 percent of its natural gas requirements. The over-reliance on costly fuel imports will impact long-term growth and development prospects, experts say.

Though coal will continue to be the major source of fuel in China, there is now a growing demand to shift away from the carbon intensive fuel. Beijing, for instance, plans to replace all of its coal-fired power plants in the central areas of the city with natural gas power plants this year to cut down the emissions and many other cities are expected to follow suit.

Experts from across the world agree that natural gas is the transitional energy that the world will largely use as it seeks to move away from old and costly fossil fuels to cheaper and environmentally-friendly renewable energy.

According to estimates provided by the International Energy Agency, natural gas will overtake coal to become the second-largest primary fuel in the world by 2035, second only to oil.

China has already set a goal of doubling its share of natural gas in the overall energy consumption to 8 percent by 2015. However, the growth in production has not been in tandem with the growth in consumption.

Costly imports

The country has been a net natural gas importer since 2007. According to IEA's projection, China is likely to double its natural gas imports over the next five years. During the same period China will also become the third-largest natural gas importer in the world after Europe and the Asia-Oceania region.

"There is no country in the world that wants to be reliant on other nations for energy supplies. The reasons for this are both economical and political," says Howard Rogers, director of the Natural Gas Research Programme at the Oxford Institute for Energy Studies in Oxford, United Kingdom.

Expensive energy imports put nations in a vulnerable position, especially when there is political turbulence across the world, says Youn-kyoo Kim, associate professor of International Studies at the Seoul-based Hanyang University in South Korea.

"The US success in shale gas has already made it less reliant on imports from the Middle East. Like the US, if China achieves a shale gas revolution it will also be less reliant on costly gas imports from Russia and the Middle East. It could also pave the way for a new cooperation mechanism in Northeast Asia," Kim says.

The shale gas revolution has helped the US to become the leading nation in terms of natural gas stocks and also cut its oil imports from 60 percent of total consumption in 2005 to 46 percent. Over the next five years, the US is also set to be a leading exporter of natural gas.

"I think China is very impressed by what has happened in the US shale sector and would like to replicate that success. However, I think it will be some time before China can achieve significant volumes of shale gas output," says Rogers from the Oxford Institute for Energy Studies.

Short run

It took the US more than 100 years, after accidentally finding shale gas, to find an affordable way to extract the natural gas from shale rock and for commercial production.

China, which started focused research on shale gas only in 2009, is looking to shorten the long march into a short run.

According to China's first shale gas development plan, which was released in March, the country is set to increase its currently next-to-zone production to 6.5 billion cu m a year by 2015, and then to 60 billion cu m to 100 billion cu m a year by 2020.

The plan is quite ambitious as conventional natural gas production in China last year was just about 100 billion cu m. By 2020, the government expects shale gas consumption in China alone to be 100 billion cu m.

That is easier said than done.

Several countries from Asia and Europe have in the past tried to emulate US success in shale gas but none of them have been quite as successful.

Despite Poland's strong desire to develop shale gas and to reduce its dependence on gas imports from Russia by offering a number of mining exploration rights to foreign companies, it has not achieved much success. Global oil major ExxonMobil had earlier this year said it was ending its search for shale gas in Poland after two wells failed to yield gas flows that were substantial enough to make commercial development viable.

Andrzej Pieczonka, first counselor at the Polish Consulate in Shanghai, says shale gas is just like a new baby. "Everybody is happy to have a new baby, but how to raise it is often a major problem," he says.

Different strokes

It took the US many years to develop and properly apply the current technology, though the companies were well aware of the shale gas reserves even as they were drilling/exploring for conventional oil and gas reserves.

China drilled its first test well for shale gas in 2010, and had 63 test wells in operation by the end of April. In contrast, the US has more than 80,000 shale gas wells in commercial operation.

Li Yuxi, a senior researcher at the Ministry of Land and Resources, says that though the early results from most of the test wells are optimistic, the outcome is still not that rosy enough to ensure profitable commercial production.

Whether an investment is profitable or not depends largely on the cost and returns from the project. According to Li, the cost of drilling shale gas in China ranges from 20 million yuan ($3.2 million) to 100 million yuan, depending on the geological situation. The average cost in the US is $3 million. "We are still in the early stages of shale gas development in China. We need to learn more about it, no matter what the cost is," Li says.

However, for investors who are interested in shale gas, cost does matter. With such high cost and an unpredictable gas price in the future, the risk of investing in shale gas is high, says Li Jun, board secretary of Zhongtian Urban Development Group, who often travels across China to attend all kinds of conferences, seminars and summits to gain information about shale gas.

Li says the listed real estate company from Guizhou province with total assets of more than 15 billion yuan is contemplating an entry into the shale gas sector.

"We can handle the risks. But I am not sure whether many of the smaller private companies have the requisite funds to drill shale gas wells. It is not like companies can drill just one well and start making money. In this business you need to drill a lot in order to find the one well that can yield abundant gas," Li says, adding that, small and medium-sized companies have fueled the shale gas revolution in the US.

Falling prices

But with more investment in the development of the sector, the cost is expected to drop.

Ye Dengsheng, general manager of a downhole service company at Chuanqing Drilling Engineering Co, an affiliated company of China National Petroleum Corp, which has drilled as many as 18 shale gas wells in China, says the extracting cost will decline further with the development of better management techniques.

He says that his Chengdu-based company spends about 60 million yuan to 70 million yuan on one well. "We plan to further hone our skills and improve efficiency. This will help reduce overall costs for each well to around 40 million yuan to 50 million yuan," he says.

According to Ye, drilling shale gas is much more difficult than conventional natural gas. "It requires more machinery, equipment and workforce. I think we've already mastered the required cutting-edge hardware for shale gas development. However, from a software perspective there are still lots of things that need to be done," he says.

It is true that for China to "re-discover" and "re-invent" these approaches will take a long time. However, it is still unclear whether China will develop a framework that will allow US companies sufficient profit incentives to transfer the technology to Chinese companies.

Global draw

Most of the world's biggest oil companies, including Exxon Mobil Corp, Chevron Corp, BP Plc and Norway's biggest energy conglomerate, Statoil ASA, are participating in China's shale gas development. Royal Dutch Shell is the first and only company that has signed a production-sharing contract with China National Petroleum Corp, the nation's biggest oil company.

However, they have limited their involvement in China to the minimum by mostly setting up joint studies and joint assessment on shale gas wells with their Chinese counterparts.

One of the reasons why foreign companies are not too enthusiastic over the shale gas prospects in China is the fact that they are not allowed to participate in bidding for shale gas blocks directly.

"The biggest attraction for them is to play large enough. If they were only given 10 percent or 20 percent of the blocks, that is not good enough for them to make money," says Adi Karev, global head of the oil and gas practice at consultancy firm Deloitte, adding that oil companies are not short of money. In fact, seven out of the top 10 global Fortune 500 companies are in the oil gas industry.

There are also other regulatory hurdles, Karev says. "It is true that there are lots of potential gas reserves in China. But companies must also understand the broader regulatory framework that is in existence in other countries. For example, the US has one of the most open markets in the world," Karev says.

Chen Weidong from CNOOC says that the US shale gas sector saw overseas investments of more than $23 billion between 2009 and 2011. Of this, at least $4 billion came from China's State-owned enterprises.

Industry experts say that the global outreach moves of Chinese SOEs are not only for gaining insights on shale gas development, but also for profits.

CNOOC Ltd has recently agreed to pay $15.1 billion in cash to acquire Nexen Inc, the Calgary-based oil and gas producer, whose assets include shale gas, in the biggest overseas acquisition by a Chinese company.

PetroChina signed a binding agreement in February to purchase a 20 percent stake in Shell's Groundbirch gas assets in Canada.

Sinopec has decided to invest $2.2 billion for a third of the US oil and natural gas producer Devon Energy Corp's interests in five developing fields.

Sinopec is also reportedly in talks with US gas producer Chesapeake Energy for its multibillion-dollar shale gas assets.

"Between 2009 and 2011, investment in China's shale gas sector was less than $1 billion," Chen says.

Action plan

"If we want to achieve the production target of 6.5 billion cu m a year by 2015, we need to invest at least $20 billion," Chen says, adding that shale gas development in China needs more than just rhetoric.

With the second auction for shale gas blocks coming up in China, there is bound to be a frenzy of activity among global companies to grab a share of the pie. There are already reports that some 70 companies have expressed interest in the bidding process, according to sources from the Ministry of Land and Resources.

Foreign companies are not allowed to participate in the bidding process directly but can team up with Chinese companies that win the bid, provided their stake is no more than 49 percent in the joint venture.

Royal Dutch Shell, the world's largest energy company by revenue, has already showed interests in such an approach in China.

Lim Haw-kuang, the executive chairman of Shell China Group, indicated during a recent meeting that the global oil major was keen to participate in China's unconventional gas exploitation projects, especially shale gas.

"I am anxiously waiting for the second shale gas tender," he said, adding that Shell is willing to cooperate with the Chinese companies that win the tender.

Despite all these risks, Karev from Deloitte still considers the Chinese shale gas industry an "attractive proposition".

"In most of the other countries, companies have to drill some gas forts and then sell it. There are no such conditions in China. The reserves are here and so also the market. It is a perfect combination.

"In theory, there is a lot of money that can be made from China. Despite the risks, companies are still wary of being involved in such a large playground like China. So they will want to get in, but with baby steps," Karev says.

mengjing@chinadaily.com.cn

(China Daily 08/03/2012 page1)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese fleet drives out Japan's boats from Diaoyu

Health new priority for quake zone

Inspired by Guan, more Chinese pick up golf

Russia criticizes US reports on human rights

China, ROK criticize visits to shrine

Sino-US shared interests emphasized

China 'aims to share its dream with world'

Chinese president appoints 5 new ambassadors

US Weekly

|

|