The miracle that cannot be undone

Updated: 2012-08-10 08:58

By Bill McDermott (China Daily)

|

||||||||

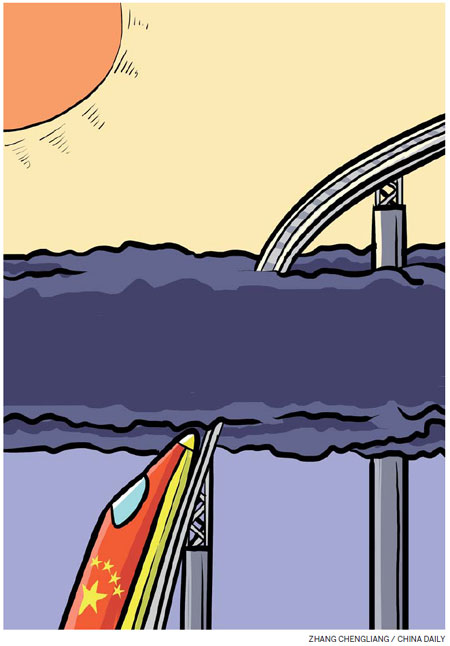

It would take a series of cataclysms to knock china off its economic course

When Chinese Premier Wen Jiabao met US business leaders last month, he called for confidence in his country's economy and a joint effort to cope with the global economic crisis.

According to government data, the Chinese economy is slowing down, with a GDP growth rate of 7.6 percent in the second quarter, down from 9.5 percent a year ago. This month the International Monetary Fund lowered its 2012 growth projection for China from 8.2 to 8 percent.

Still, I support Wen's cautiously optimistic appeal. Even though the economy is growing at a slower pace, predictions of a dramatic downturn in China are nonsense. There are big possibilities in the growing middle class, increasing urbanization and development, and active government investment.

As China becomes more global, more moderate growth in its economy may even be a perfect incentive to switch to a more green, modern, and efficient economy.

First off, it is worth pointing out that at $7.3 trillion the Chinese economy is already huge by all economic standards. The gravity and momentum of such an economy is considerable. It would take episodes of earthshaking proportions to dramatically restrict business activity on this scale once it is under way.

For instance, consider the impact of the Tohoku earthquake and tsunami that struck Japan last year. Japan was the world's third-largest economy before the earthquake struck, and still is today. Despite the enormous human tragedy of the disaster and the huge national and international effort to rebuild the nation, experts have estimated that the calamity may have knocked only half of 1 percent off the country's 2011 GDP.

China today has returned to its longstanding historical role of a leading global economic power, and its importance will continue to increase. Even the most pessimistic of China bears are only arguing about how much China's spectacular growth may slow over the next few years. In truth, China is well positioned to move from strength to strength for years to come, based on smart strategic moves it has made in recent years.

I am particularly excited about the new breed of small and medium-sized Chinese companies. They are investing in globalization to expand into new markets and become operationally efficient. Mid-market innovators like the medical-device manufacturer Mindray are posing challenges to Western competitors and shaking up the global landscape in their sector.

Chinese enterprises are making full use of e-commerce to reach their domestic market in new ways, betting largely on mobile solutions. E-commerce in China is expected to increase dramatically in the near future, which will create more opportunities and growth. There is an increase in the number of initial public offerings, and patent applications are being filed in record numbers. These are all very encouraging signs.

China's domestic economy is particularly prepared to succeed. The middle class has grown substantially, and now comprises well-educated, eager, tech-savvy consumers. The per-household disposable income of urban consumers is expected to double between 2010 and 2020, to about $8,000.

Just as a strong middle class has served as the backbone of many Western economies, the rise of the Chinese middle class will likewise contribute to further growth.

While the middle class is expanding fast in growing urban areas, plenty of consumer-conversion opportunities still remain in less-developed regions that the government has specifically targeted for higher economic growth. Many untapped middle-class consumers reside in second and third-tier cities in western and central China, which are just beginning to develop, grow and go global.

Finally, the government is taking significant action to make its economy more sustainable. In its 12th Five-Year Plan (2011-15), the government has given priority to the quality of growth over the quantity of growth, highlighting investments in education, technology, and R&D - as well as in knowledge and service industries. It has also just announced tax breaks to encourage new investment from overseas.

At SAP AG, we are proud of our strong and growing presence in China. Last November we announced that we would be spending more than $2 billion in the country through 2015, and we have just had our best-ever quarterly performance in China. This year we have opened three new Chinese offices and hired more than 600 people, bringing our total number of local employees to 3,500. We serve 4,000 Chinese customers with leading-edge business applications and analytics, as well as database, mobile, and cloud solutions. And last month we had more than 17,000 attendees at our annual Sapphire Now conference and trade show, with 190,000 people participating virtually.

China's IT industry is developing rapidly. We are already developing more innovative software solutions in China for domestic customers as well as for export. And like many other Western firms we will benefit from continued long-term investment and expansion in the country.

China is destined for success. The economic slowdown is real, but there is no reason for pessimism. People looking at China should take the long-term view and see how fast this vibrant economy is changing, innovating and adapting to a globalizing economy. The Chinese miracle is here to stay.

The author is co-CEO of business software maker SAP AG. The views do not necessarily represent those of China Daily.

(China Daily 08/10/2012 page8)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese fleet drives out Japan's boats from Diaoyu

Health new priority for quake zone

Inspired by Guan, more Chinese pick up golf

Russia criticizes US reports on human rights

China, ROK criticize visits to shrine

Sino-US shared interests emphasized

China 'aims to share its dream with world'

Chinese president appoints 5 new ambassadors

US Weekly

|

|