L'Oreal's alluring number: 1 billion

Updated: 2012-11-23 08:54

By Yao Jing (China Daily)

|

||||||||

|

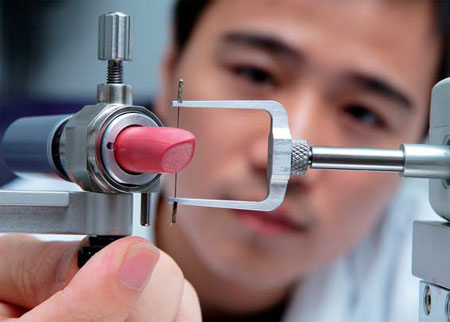

L'Oreal China says it is dedicated to research and innovation to serve the needs of Chinese and Asian consumers. Provided to China Daily |

The cosmetics maker is out to attract millions of customers, and guess which country it thinks can help it do that?

Like any big company, the cosmetics maker L'Oreal is not shy about its ambitions, but just how big the French company's ambitions are becomes clear when you consider the numbers it talks about.

In its annual report last year it said it had set itself a target "to conquer one billion new customers in the next decade". That would mean doubling the number of customers the company now has, it said.

Those ambitions may come across as far-fetched to some, but L'Oreal is crystal clear with at least one thing: as it tries to make that dream become a reality, China will play a significant role.

"Right now, China is the third-largest market for L'Oreal worldwide," says Alexis Perakis-Valat, chief executive officer of L'Oreal China. "We are sure that China will be No 1 one day. There is no doubt about it."

L'Oreal's sales in the Asia-Pacific region rose 12.5 percent in the first half of this year compared with the corresponding period last year, to reach 2.13 billion euros ($2.7 billion), while its European sales rose by a meager 1.9 percent.

As for L'Oreal China, its sales totaled 10.7 billion yuan ($1.7 billion; 1.3 billion euros) last year, 18 percent higher than in the previous year, helping the company to extend its double-digit growth to 11 consecutive years.

The company's solid confidence in the Chinese market is being propelled predominantly by two things: the seemingly inexorable upmarket shift of its consumers and the potential for geographic expansion.

"The country still has a lot of cities that do not have luxury beauty brands and have room for mass products," Perakis-Valat says.

The cosmetics market in China was once strongly concentrated in the very big cities like Beijing and Shanghai, but now the lower-tier ones are opening up, he says.

"The lower-tier cities are giving us a big opportunity at the moment. We have our mass-market brands, including Maybelline and Garnier, in more than 300 cities. And for luxury brands, we have opened in more than 70 cities for Lancome."

L'Oreal came to China in 1997, starting from four brands to 20 today, including Garnier, Kerastase, Lancome, L'Oreal Paris, Matrix, Maybelline, Vichy and Yue-Sai.

In the fist half of this year, the company's mass-beauty division had turnover of 5.45 billion euros, a rise of 4.7 year-on-year, while turnover in the luxury division, though just under half that amount, rose at more than double the rate.

In China, the situation is almost the same.

"Luxury is expanding geographically in China while mass is already everywhere," Perakis-Valat says.

For L'Oreal that means grabbing a greater share of the mass market and beating others to take luxury cosmetics to new cities, he says.

Another component of staying ahead is research and innovation, something in which L'Oreal takes particular pride. It boasts that it has research centers worldwide, and that last year alone it spent 720 million euros on research and registered more than 600 patents. But that innovation and experimentation is not limited to chemicals and test tubes.

Electronic skin-care devices are now emerging as an important market category, and L'Oreal plans to introduce Clarisonic, a market leader in such devices, to China at the end of this month.

L'Oreal completed its acquisition of Pacific Bioscience Laboratories Inc at the end of last year, Perakis-Valat says, and "we hope to grab the opportunity in instrumental cosmetics in China also".

While such devices may have universal appeal, L'Oreal, after 104 years in business, is wise enough to know that with certain products you have to carefully choose your markets.

"Beauty is not a one-size-fit-all business," Perakis-Valat says. "We have to respect diversity and should not come up with one brand that serves all the needs."

More than 70 percent of what it sells in China is specifically formulated for this marketplace, the company says. Maybelline BB cream is a case in point.

"Chinese women want their skin to look much more natural, with much less covering and more hydrating," he says. "This was developed for China and in China, and now other countries have adopted it."

In 2004, L'Oreal bought the highly successful local brand Yue-Sai, founded 20 years earlier by the Chinese-American TV celebrity Yue-Sai Kan, and it has been reaping the rewards ever since.

In September a new Yue-Sai product, Cordyceps Rejuvenate, containing a highly prized fungal ingredient said to help combat the first signs of aging, went on the market.

L'Oreal has also discerned a wider public acceptance of the benefits of Chinese traditional medicine, and is exploiting that.

"We work with labs to see what ingredients from Chinese medicine are really effective on the skin," Perakis-Valat says. "Yue-Sai has experience of over 20 years of dedicated and in-depth study of Chinese skin fundamentals, and we are very satisfied with the performance of the brand."

The company also attributes its achievements in China to the talent of its Chinese staff. Of its 3,000 employees in the country, less than 1 percent are foreigners, the company says.

"The future of our success relies on products and people. Besides providing quality and diverse products, we are very focused on recruiting and developing great Chinese people, training them, sending them abroad, etc," Perakis-Valat says.

L'Oreal's presence in China includes two manufacturing plants, a management development center for talent development, an Asian-Pacific Operation Division and a research and innovation center dedicated to understanding and serving the needs of Chinese and Asian consumers.

Last year, the company announced it was investing 200 million yuan to turn its plant in Yichang, Hubei province, into the group's largest make-up production center in Asia. At the same time, it created a consumer care center in Shanghai, the first of its kind in the industry, to upgrade consumer service.

In a way, those developments reflect the sea change in China since L'Oreal first arrived in the country 14 years ago. At that time, seeing a woman with makeup was a rarity. L'Oreal built its business in the country by convincing women of the need to do more than just hydrate their skin, and these days even men are getting into the act.

But as L'Oreal toils away to attract those one billion consumers worldwide, Perakis-Valat insists the work must go on.

"We have to cope with the pace and understand the changes, and then, being very fast in coming up with solutions to fill these needs."

yaojing@chinadaily.com.cn

(China Daily 11/23/2012 page11)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese fleet drives out Japan's boats from Diaoyu

Health new priority for quake zone

Inspired by Guan, more Chinese pick up golf

Russia criticizes US reports on human rights

China, ROK criticize visits to shrine

Sino-US shared interests emphasized

China 'aims to share its dream with world'

Chinese president appoints 5 new ambassadors

US Weekly

|

|