Share market 'needs to be reformed'

Updated: 2012-12-07 07:37

By Andrew Moody (China Daily)

|

||||||||

|

Junheng Li says having an intimate knowledge of China has been good for her career. Cui Meng / China Daily |

Many only pay lip service to govt's aim for economy upgrade, says founder of US equity analyst firm

Junheng Li believes Chinese companies need to up their game if they want to attract international investors.

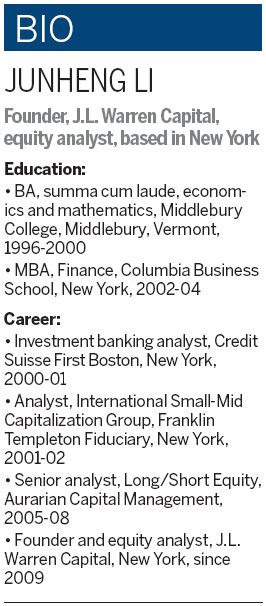

The Shanghai-born founder of J.L. Warren Capital - the New York-based equity analyst firm - and high-profile commentator, is nothing if not direct.

"There are still a lot of issues with Chinese companies. There is the opaque corporate governance issue, which is widely discussed. But there are still too many Chinese companies whose business model is based on cost cutting.

"Sure, you can cut costs and sustain growth but it is not really sustainable because eventually someone else will come and undercut you."

Li, with a permanently-attached BlackBerry in hand, commanded a certain presence as she arrived in the lobby of the J.W. Marriott Hotel in Beijing. Despite only being in her 30s, she already has secured a Wall Street reputation as an investment expert and is a regular contributor to forbes.com and Bloomberg as well as other media outlets.

She was in China to research Chinese mid-cap shares, which she says is sometimes a frustrating experience because many only pay lip service to the government's aim for the economy to move up the value chain.

"I had breakfast a few years ago at the Westin in Shanghai with the CFO (chief financial officer) of a Chinese maker of chips for MP3 players. The company was nothing fancy but had been an early home run for me as an investment," she recalls. "I was so jet-lagged and very mellow and not threatening, and we were just chatting. I found out that his investment in research and development was only 2 percent of revenue. I realized then the share price was going to fall because the figure for a technology company needed to be between 15 and 20 percent."

With the Shanghai Composite Index, China's main stock index, falling to a 46-month low in November, at below 2000 - having lost more than two-thirds of its value from its heady October 2007 high of 6124 - there remains a disconnect between a still fast-growing economy and the financial markets.

"The economy and the market are totally different because 70 percent of the market is large SOEs (state-owned enterprises) and a lot of them banks and so not a true reflection of the overall climate.

"Most of the stocks used to be owned by retailers but since the crash they have left and not come back in. I think there is a crisis of confidence."

Li, who despite being engaging company only slightly conceals a steely determination, left China 16 years ago, although her parents still live in her home country. She says her upbringing made the type of strict Chinese parenting in Yale professor Amy Chua's best-selling book Battle Hymn of the Tiger Mother seem like a cakewalk.

"My upbringing was like hers on steroids. I read parts of her book and thought that was nothing."

She forced herself to get top marks in exams by sheer willpower and had to bike after school in Shanghai to a test preparation school for a further three hours of tuition.

The dedication and hard work paid off and she won a scholarship to Middlebury College in Vermont.

"The school came to pick us up and I thought after all the struggles I had been through that my English was very good. I suddenly realized that, 'Oh my God, I am going to get killed'. I didn't understand anything. I was so miserable," she says.

But she soon found her feet and became a star student achieving a summa cum laude in her bachelor's degree in economics and mathematics.

A career in finance beckoned and she arrived in Wall Street, just before the Nasdaq crashed as the dotcom bubble burst in 2000.

"I had been told to read the Wall Street Journal at college and found it very interesting. A lot of people are intimidated by numbers, but actually it is not about numbers but the people behind the numbers."

She initially went into banking with Credit Suisse First Boston before becoming a small mid-cap analyst at Franklin Templeton Fiduciary.

"It was one of the nicest, oldest fund managers in the US and we had unlimited resources. I was flying all over Asia to see companies and I was just 24," she says.

"I would travel with an economist and an analyst and would learn so much from them on flights and trains going from company to company."

She took time out to take an MBA at Columbia and after a successful decade on Wall Street decided to launch her own equity research company in 2009. She is currently in the process of launching her own fund for professional investors.

Li has built a reputation for shorting stocks, taking a bet a particular share will fall in value and agreeing to buy it in future at a lower price.

It is seen by some as a controversial method of investing but Li believes it drives economic efficiency.

"People hate shorting because it is humongously misunderstood. I believe it is important to the efficient operation of the market. What you are doing is taking liquidity out of a badly-performing company and allocating it to a company you think will do better," she says.

Li says some Chinese companies acquiring listings on the New York Stock Exchange in recent years have given investment in the world's second-largest economy a bad name.

"The first companies around 2006 or 2007 were very successful but those who wanted to invest in China had a very limited pool to invest. Other Chinese companies, which didn't really want to come in, were then chased by bankers who wanted a fee and that resulted in problems," she says.

Li says one of the best ways for investors to benefit from the China market is by multinationals with exposure to it, such as Apple and Yum! Brands, owner of KFC and Pizza Hut, which makes 60 percent of its profits in the country.

"You can still invest in the same China growth story but circumvent some of the corporate governance issues that surround some China stocks."

She believes China's new leadership will focus on improving the investment markets in China and that will provide a boost to shares.

"The fact that the domestic stock market hasn't appreciated at all, even with 400 percent GDP growth over 12 years, clearly indicates a type of confidence crisis. The share market needs to be reformed to be more in line with the regulations and rules in the developed markets."

Li says that despite enjoying trips home, she has adapted to her new life in New York.

Yet her DNA remains Chinese, and she admits having an intimate knowledge of China has been good for her career.

"My edge is that I am Chinese, so when I speak I have some credibility just because I am Chinese. I should not really leverage that advantage indefinitely because it becomes an abuse of something that in itself should not be the support of what I do."

andrewmoody@chinadaily.com.cn

(China Daily 12/07/2012 page24)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese fleet drives out Japan's boats from Diaoyu

Health new priority for quake zone

Inspired by Guan, more Chinese pick up golf

Russia criticizes US reports on human rights

China, ROK criticize visits to shrine

Sino-US shared interests emphasized

China 'aims to share its dream with world'

Chinese president appoints 5 new ambassadors

US Weekly

|

|