Chinese economy to slow more: World Bank report

Updated: 2015-04-14 11:45

By Amy He in New York(China Daily USA)

|

||||||||

If China faces a significant slowdown, it could exert "significant spillovers" on countries that are commodities exporters, a new World Bank report on the East Asian Pacific economy said.

"The significant negative impact on Australia and New Zealand, among the world's largest commodity suppliers, would lead to indirect spillovers on the Pacific Island Countries, given their tight links through trade, investment and aid," the World Bank said.

The region's exporters also could be hurt by weak European and Japanese demand, and if China were to see much slower growth, economies in the region could experience slower growth themselves.

The World Bank report, released on Monday, said that China's growth decelerated because of attempts to avoid a sharp slowdown, and that growth will continue to moderate further.

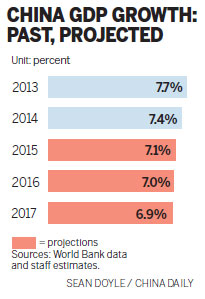

It said that China will grow 7.1 percent in 2015, and 6.9 percent in 2017, "reflecting continued policy efforts to address financial vulnerabilities and gradually shift the economy to a more sustainable growth path".

It said that China's measures to reform the economy - through the containment of debt and shadow-banking and controlling pollution - will "reduce investment and manufacturing growth," but that the stimulus "is expected to continue to mitigate the impact on short-term growth, should this show signs of slowing considerably below the government's indicative target of about 7 percent."

China's export sales contracted 15 percent in March. The drop in exports, compared with expectations for a 12 percent rise, could heighten worries about how a rising yuan has hurt demand for Chinese goods and services abroad.

The yuan's strength was one factor in March's 19.1 percent on-year decline in exports to the European Union and 24.8 percent drop to Japan.

In a sign that domestic demand was also tepid, imports into China shrank 12.7 percent last month from a year ago, the General Administration of Customs said on Monday. By volume, coal imports plunged more than 40 percent in January-March.

China will face short-term declines as it implements reforms, and the World Bank said that "it is critical that any offsetting stimulus measures be designed so as not to undermine restructuring efforts."

In particular, fiscal stimulus programs need to avoid increases in local government debt, it said.

The report - East Asia and Pacific Economy Update - also said that growth in developing economies in the East Asian Pacific economies moderated from 7.2 percent in 2013 to 6.9 percent in 2014 because of slowdowns in China and some ASEAN economies.

Ann Lee, professor of economics and business at New York University, said that, "there are many exogenous factors like falling oil prices and interest rates in the US that can affect growth in the Asia Pacific".

China's slower growth is "just one factor, and hardly a drag, since without China, Asia's growth would be nowhere near their current growth rates, which are far higher than any other part of the world", she said.

Patrick Chovanec, managing director of Silvercrest Asset Management Group and a professor at Columbia University's School of International and Public Affairs, said that East Asian Pacific economies' relationships with China's are more complicated than the World Bank report says. Just because China's growth declines, does not automatically mean that it's bad for economies in that region.

"It all depends on the type of economic relationship these countries have with China," he said. There may even be instances where declining Chinese growth may be good for neighboring economies because it means that the Chinese government is implementing reforms for the country that may result in less growth in the short term, but lead to more qualitative growth in the long term, he said.

Another challenge that China faces as it evolves from a manufacturing-led economy to a middle class, service-based one is the issue of relocating its manufacturing sector to lower-cost areas across the East Asia Pacific region, but "such international relocation has so far proved limited," it said.

Two big developments in the global economy were the sustained decline in world oil prices and the rapid rise in the value of the dollar, which has helped growing countries at the cost of others, the World Bank said.

Reuters contributed to this story.

amyhe@chinadailyusa.com

Ex-student sought in shooting death of North Carolina college

Ex-student sought in shooting death of North Carolina college

Women in politics - Hillary Clinton is just one of them

Women in politics - Hillary Clinton is just one of them

10 Red Dot Award winning carmakers in '14

10 Red Dot Award winning carmakers in '14

Get a birthday cake for your pets

Get a birthday cake for your pets

7 ways to beat 'spring sleepiness'

7 ways to beat 'spring sleepiness'

Legendary painting of Mona Lisa recreated

Legendary painting of Mona Lisa recreated

National festival underway with cherry blossoms in peak bloom

National festival underway with cherry blossoms in peak bloom

Ten photos you don't wanna miss - April 13

Ten photos you don't wanna miss - April 13

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US to help smart

cities quest

Clinton's win not guaranteed despite global celebrity

US has record number of applications for H-1B tech visas

Chinese economy to slow more: World Bank report

China's slow down has upside

US voluntary medical team funded for China trip

Hilary Clinton launches

presidential campaign

'No room' for election China-bashing: US politicians

US Weekly

|

|